Insights appear to be funny things. They don’t necessarily depend on data, but, without corroboration in the objectively measurable, insights must be taken on faith. In essence that’s a slippery slope to superstition and subjective decision making.

Sleuthing is everything. Insights are something one usually has to work for, and, more often than not, that involves vetting the data from every conceivable angle (what’s there, what’s not there, what it implies, what it leaves to the imagination, what one still has to dig for, etc).

Sleuthing is everything. Insights are something one usually has to work for, and, more often than not, that involves vetting the data from every conceivable angle (what’s there, what’s not there, what it implies, what it leaves to the imagination, what one still has to dig for, etc).

Even the absence of data can deliver powerful insights, because it forces the mind to consider alternate explanatory scenarios that might never suggest themselves if one had all necessary information handed to one in advance. Not just that, but the presence of data that’s inaccurate, corrupted, or falsified can sensitize one to the need to hedge whatever insights one might gain from the available high-quality data. It’s too easy to let undetected data-quality issues skew ones insights.

Some cynics regard big data as a “the more the merrier” data fetish. Their concern is valid to the extent that some people seem to regard data volume as a necessary and/or sufficient condition for high-quality insights. The “small data” backlash against big data seems to grow out of a popular concern we’re being encouraged to do data-overkill analysis in every possible scenario.

IBM’s big data evangelist and author of this blog, James Kobielus picked examples from an article on “Big Data, No Data Paradox”, which focuses on healthcare management applications, of scenarios involving three anomalous data categories: missing data, no-value data, and/or valid data that “blows the whistle” on possible data quality issues stemming from fraud, incompetence or negligence. To read more click on above link.

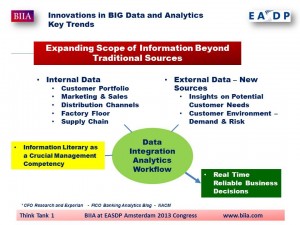

BIIA Comment: It is well known that our friends from the credit management profession have similar examples up their sleeves in dealing with the “no-data – incomplete data” syndrome. Not too long ago we came across an interesting research paper “Unlocking the Value of Business Information”, which recommended that managers should tap into non-traditional external and internal data sources and above all become more information literate.

BIIA Comment: It is well known that our friends from the credit management profession have similar examples up their sleeves in dealing with the “no-data – incomplete data” syndrome. Not too long ago we came across an interesting research paper “Unlocking the Value of Business Information”, which recommended that managers should tap into non-traditional external and internal data sources and above all become more information literate.