![]() The latest Dun & Bradstreet Global Business Impact (GBI) Score highlights a slight worsening of risks facing businesses across the world. Despite the relative stability of the score over the past three quarters, the Q2 2016 GRM has six new entries, highlighting that, in an increasingly complex and globalized world, finance, procurement and supply chain teams across all sectors of business face urgent and ever-evolving risks.

The latest Dun & Bradstreet Global Business Impact (GBI) Score highlights a slight worsening of risks facing businesses across the world. Despite the relative stability of the score over the past three quarters, the Q2 2016 GRM has six new entries, highlighting that, in an increasingly complex and globalized world, finance, procurement and supply chain teams across all sectors of business face urgent and ever-evolving risks.

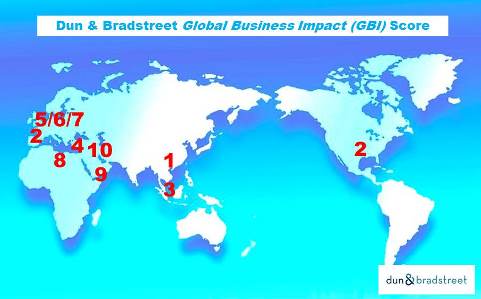

The top ten risks combine an assessment of (i) the event’s probable magnitude on the global business operating environment and (ii) the likelihood of it happening.

The two biggest risks highlighted this quarter are two new entries given by: the threat of possible default contagion in China particularly for mid-tier banks (with a GBI of 30 out of a maximum of 100) and the potential breakdown of TTIP negotiations between the US and the EU (GBI of 30) following the US presidential elections.

In third place with a GBI of 28, down from first place in the previous report (GBI of 40), is another risk emanating from the Asia-Pacific region: it is concerned with the likelihood of Chinese real GDP growth slowing to below 5%, while a second pan-regional risk is a new entry at four: the potential collapse of the migrant deal between the EU and Turkey (GBI of 24).

In third place with a GBI of 28, down from first place in the previous report (GBI of 40), is another risk emanating from the Asia-Pacific region: it is concerned with the likelihood of Chinese real GDP growth slowing to below 5%, while a second pan-regional risk is a new entry at four: the potential collapse of the migrant deal between the EU and Turkey (GBI of 24).

The importance of West and Central Europe to the global economy is highlighted by the inclusion of three risks, all associated with the stability of the EU. Respectively in 5th, 6th and 7th position these risks are given by: the likelihood of popular resistance to austerity rekindling the Grexit debate (GBI of 22), risk which has increased compared to the previous report, the potential British exit (Brexit) from the EU (GBI of 21), and the fear of another hung parliament in the June election in Spain (GBI of 20). The latter two entries being new risks.

The final three positions, 8th, 9th and 10th, with a GBI equal to 20, are given respectively by: the concern of a possible strengthening of the US dollar, risk among the six new entries, the likelihood of the weak oil price fuelling social unrest in oil-exporting countries, decreased risk compared to previous report, and finally the risk of civil wars in Iraq, Syria, Yemen and Libya spreading into neighbouring countries, unvaried risk compared to previous report.

Source: CRIBIS News