Bain & Company has conducted a global survey measuring how people consume culture in the form of digital media—video, music, e-books and video games. For our members who are interested in consumer behavior concerning digital media and devices we recommend to read this report. The following is an excerpt of the Bain report.

Bain & Company has conducted a global survey measuring how people consume culture in the form of digital media—video, music, e-books and video games. For our members who are interested in consumer behavior concerning digital media and devices we recommend to read this report. The following is an excerpt of the Bain report.

By surveying more than 6,000 consumers in Europe, the US and the BRIC (Brazil, Russia, India and China) countries, Bain learned about changing preferences for how they watch, listen, read and play.

The survey results highlighted three key trends in

- The rise of individual and social consumption driven by smartphones and tablets

- The end of content scarcity as digital distribution achieves ubiquity

- A shift away from ownership enabled by “always-on” networks

These changes occur against a backdrop of the persistent culture clash between the creative and digital worlds. Last year Bain noted the innovative power of digital platforms over the past seven years: iTunes is synonymous with music downloads, YouTube with streaming video, Kindle with e-books. But the rise of giants creates unease. Apple, Google, Amazon, Microsoft and Facebook make headlines as much for the business, regulatory and cultural controversies they generate as for the new behaviors they have fostered.

The rise of digital platforms also highlights the evolving role of curation, as consumers look for better ways to find the culture they want the most. As power shifts to consumers – who can program their own content using powerful technology and simple interfaces – curation moves out of the hands of professionals and into communities, platforms and algorithms. This creates a real danger of a “tyranny of demand,” as indicated by the prevalence of franchises over original creation in increasingly risk-averse industries. Nevertheless, media players that can offer the right content – that is, not only what consumers want today, but what will surprise them tomorrow – are likely to prevail.

Bain expects the current state of unease and uncertainty to lead to a new balance between supply and demand. Every player in the content ecosystem has a role to play in defining this new equilibrium, around three main issues: transforming the role of content publishers, building consumer insight while addressing privacy concerns and re-charting funding paths for great content.

In light of ever-changing consumer dynamics and business models, Bain believes content publishers can follow three critical paths:

- Invest in original content and gain a stronger foothold in production. Amid turbulence in consumer behavior and distribution models, distinct content emerges as more critical than ever. For many publishers, this will require a move upstream, from mere aggregation to increasing involvement in production itself.

- Build scale to maintain a differentiated access to talent and funding. Only those publishers who can fund a diverse portfolio of projects will be able to secure prime placement on digital platforms while absorbing the risks inherent to creative endeavors. They can achieve such scale either through vertical integration or geographic expansion.

- Embrace data analytics to complement editorial approaches. Acquiring consumer data capabilities and infusing data-driven approaches into existing marketing, programming and creative processes may require a combination of talent investment, digital acquisitions and joint ventures with global and vertical platforms.

More than ever, winning strategies will be based on quality original content that stands out in an increasingly crowded marketplace. But they will also require deep, analytical insight into consumer behavior. In our view, blending these two worlds represents both the biggest challenge and the most promising opportunity media companies are facing today.

Devices: From households to individuals

“Our 2011 study (“Connected devices and services: Reinventing content“) highlighted the growth of connected platforms and their impact on media consumption. Two years later, smartphones and tablets have clearly emerged as the fastest-growing devices. They have reached mass markets not only in Western countries, with more than 60% owning a smartphone and almost 40% owning a tablet, but also in emerging countries, with China and India respectively the first- and third-largest smartphone markets today.

Tablets and smartphones are driving a quiet revolution in the lives of millions of users who listen to, watch, read and play content on them. In Western countries, up to 20% of tablet users aged 15 to 34 use it as their primary device to play games. Among respondents 15 to 34, 25% say they watch less traditional TV in order to watch their programs on mobile screens—twice as high as the percentage of the general population. Tablets and smartphones create new moments of viewing, playing and listening on the go, and more media multitasking than ever. With applications and app stores as the gateway to content, these devices defy both the 60-year-old remote control and the 20-year-old search engine. They challenge the historical notion of household consumption by making content personal, customized to individual tastes and influenced by larger, online social communities rather than by only nearby friends and family.”

The survey report contains an interesting comment concerning data challenges: Building consumer insight while addressing privacy concerns

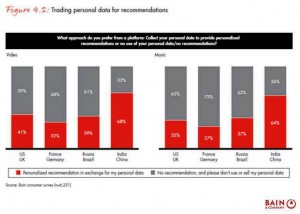

New curation approaches all rely extensively on analysis of consumer data. Recent events have highlighted increasing sensitivities on the capture and analysis of personal data. Still, there are significant differences between geographies (see Figure 4.2). Most users in France and Germany are ready to do away with the personalized recommendations they find useful to keep their personal data confidential. On the other hand, consumers in India and China seem much less aware of or less concerned about privacy issues: more than 60% of them would rather obtain personalized recommendations even if it means relinquishing some personal data.

Overall, digital platforms and media companies will have to invest in noninvasive, “opt-in” viral marketing techniques to share recommendations via social networks, rather than mine the data consumers may have left inadvertently open to marketing uses. As they tread such new ground, publishers will have to manage these new sensitivities carefully, working with consumers and regulators to find the right balance between personalized services and privacy.

The Bain survey of more than 6,000 consumers in eight countries points to three key trends in 2013: the rise of individual consumption driven by smartphones and tablets, the end of content scarcity as digital distribution achieves ubiquity and the shift away from ownership enabled by “always-on” networks.

To read the full report click on this link. Source: Bain & Company