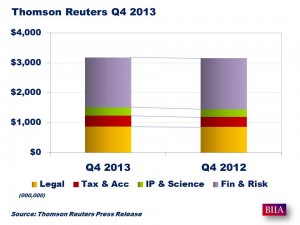

Thomson Reuters (TSX / NYSE: TRI) reported revenue growth of 2% for the full year and 1% for the fourth quarter, before currency impact. Including a $260 million charge in the fourth quarter, adjusted EBITDA was down 7% for the full year and down 32% for the fourth quarter Including a $275 million charge in the fourth quarter, underlying operating profit was down 15% for the full year and down 50% for the fourth quarter.

Thomson Reuters (TSX / NYSE: TRI) reported revenue growth of 2% for the full year and 1% for the fourth quarter, before currency impact. Including a $260 million charge in the fourth quarter, adjusted EBITDA was down 7% for the full year and down 32% for the fourth quarter Including a $275 million charge in the fourth quarter, underlying operating profit was down 15% for the full year and down 50% for the fourth quarter.

“I am pleased that we were able to deliver on our full-year expectations, despite a tougher than expected external environment in the fourth quarter,” said James C. Smith, chief executive officer of Thomson Reuters.

“More importantly, we took significant strides to position the company to thrive in future years. Our transformation initiatives are taking hold, costs are coming out and innovation is coming forth. Specifically, the charge we announced for 2013-14 is just one necessary element of the changes we have put in place to enable us to drive growth across the enterprise,” said Mr. Smith.

“While the external headwinds were stronger than anticipated at year-end, particularly in Europe and the emerging markets, I am pleased with the progress we continued to make inside the company and with our customers. I am confident this progress will accelerate in 2014.”

Thomson Reuters Governance, Risk & Compliance Segment Revenues grew 14% (10% organic) to $247 million due to strong demand for regulatory and compliance products and services. Revenue in the fourth quarter grew by 13% (8% organic) to $69 million.

Source: Thomson Reuters Earnings Release