According to the Federal Law #67-FZ of 30 March, 2015 Russian Tax authorities are entitled to check the correctness (reliability) of company data of registered and to be registered companies in the Unified State Register of Legal Entities (EGRUL Register maintained by the Federal Tax Service of Russia).

According to the Federal Law #67-FZ of 30 March, 2015 Russian Tax authorities are entitled to check the correctness (reliability) of company data of registered and to be registered companies in the Unified State Register of Legal Entities (EGRUL Register maintained by the Federal Tax Service of Russia).

As of September 1, 2017, the Federal Law #488-FZ of 28 December, 2016 has set the stage for removing companies from the EGRUL Register if the Tax Authorities have determined that a company has not updated its data as required by the EGRUL Register. Therefore once a notation about ‘incorrect’ data is on record for 6 month the Tax Authorities can take decisive action to remove a company from the register. This is one mechanism the Tax Authorities regularly uses in fighting fraudulent companies.

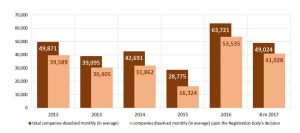

Picture 1. Dynamics 2012-2017: change in the number of dissolved Russian companies (monthly, in average)

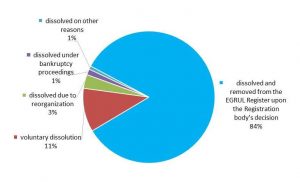

The trend has continued: for 8 months of 2017 most companies (84%) ceased operations by being removed from the EGRUL Register upon the Registration body’s decision (Picture 2).

Picture 2. Reasons of Russian companies’ dissolution (share %, for 8 months of 2017); Source: EGRUL Register (maintained by the Federal Tax Service of Russia)

The “incorrect data” definition can apply to any company: One of the first consequences are that banks will close accounts essentially denying access to the financial system. Furthermore companies will be excluded from state procurement and tenders. A damaged reputation will significantly contribute to the cancellation of contracts. Bringing administrative action against a company’s CEO or shareholder is tantamount to restricting their rights.

Even prosperous companies may be accused of having “incorrect” registration data: For instance, the Tax authorities may question the correctness of office locations if correspondence is returned; if at the same address are registered over 5 other companies; if a company fails to update information about a CEO’s change or if it failed to notify the local tax authorities within the required timeframe. Once a company has received notification that incorrect data has been detected, its managers and shareholders have one month to provide correct information. If no updated or corrected data has been filed, the company will be accused of having filed “incorrect’ data.

According to the Information and Analytical system Globas https://globas.credinform.ru/en-GB/home/auth , developed by Credinform, a Russian provider of company information, as of October 2017, nearly 410,000 Russian companies are classified as being delinquent in correcting their registration records in the EGRUL Register. It applies mainly to entries concerning company address, CEO/owner data, shares & collaterals.

Regular verification of a company’s business practices can help to avoid a potentially negative impact of doing business with Russian counterparties.

Source: Credinform Russia