TransUnion Analysis Finds FinTechs Outpacing Traditional Lenders in Personal Loans Issued to Near Prime and Prime Borrowers. Personal loan originations to consumers with credit scores between 601 and 720 have increased 122%

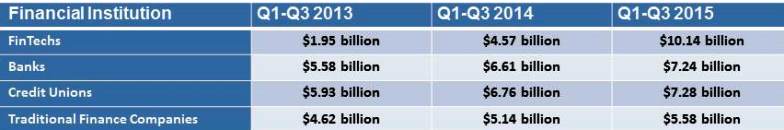

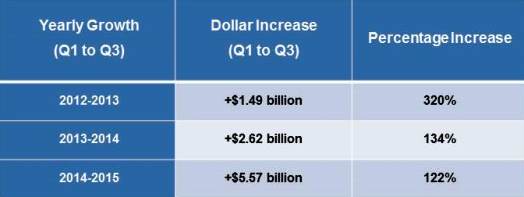

A new TransUnion (NYSE:TRU) analysis unveiled today at the LendIt USA 2016 Conference found that FinTech lenders have surpassed banks, credit unions and traditional finance companies in personal loan issuance to near prime and prime consumers. FinTech lenders originated loans totaling $10.14 billion to these consumers in the first three quarters of 2015, a 122% increase from $4.57 billion issued in the same interval of 2014.

Personal Loans Issued to Consumers with a VantageScore between 601-720

In 2015, more than half (52%) of all personal loans were issued to the nation’s 92 million near prime consumers (those with a VantageScore® 3.0 credit score between 601 and 660) and prime consumers (those with a VantageScore® 3.0 credit score between 661 and 720). While all types of lenders have experienced increased originations to near prime and prime borrowers, FinTech lenders remained well above banks, credit unions and financial institutions.

In 2015, 15.69 million consumers had an open personal loan on their credit files, an increase of 1.58 million since 2014 and 3.12 million since 2013. With this surge in lending, FinTechs have increasingly originated more loans to near prime consumers and prime consumers in the past three years.

FinTech Personal Loan Growth to Prime and Near Prime Consumers

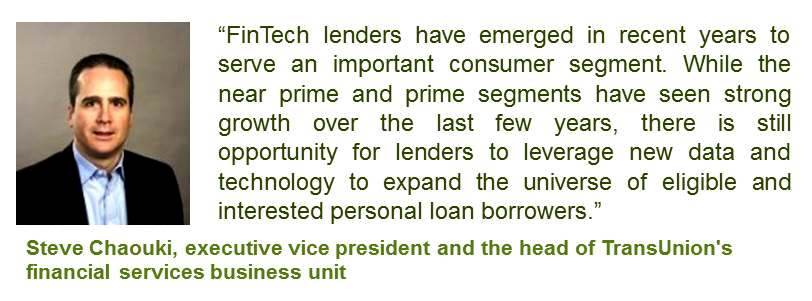

“Personal loans remain an attractive option for borrowers in all risk tiers, and FinTechs have seized an opportunity to develop a niche within the nearly 92 million consumers in the near prime and prime risk tiers,” said John Wirth, TransUnion’s vice president of consumer lending and FinTech. “These well-funded, nimble FinTechs have grown their market share at a rapid pace and are increasingly appealing to consumers in these risk tiers.”

To learn more about TransUnion’s solutions for FinTech lenders, please visit www.transunion.com/fintech

Source: TransUnion