TransUnion survey highlights consumer media consumption and generational differences – Survey Finds More Consumers Shifting to Streaming Platforms; Migration Expected to Continue in 2021

Since the onset of the COVID-19 pandemic, seven in 10 U.S. consumers (71%) say they have increased their use of paid streaming services. The findings come from a new TransUnion (NYSE: TRU) survey administered in November – a follow up to a May survey which found 56% of consumers had increased their usage since the pandemic began in March.

Subscription-based streaming providers, including platforms such as Amazon Prime, Hulu, Netflix and Apple TV, have continued to see growing adoption among consumers over the past several months. The TransUnion survey supports this trend, finding that on average, consumers are spending 3-4 hours a day consuming streamed media, with 55% opting for this form of entertainment in place of a cable TV subscription.

“COVID-19 has upended the entertainment landscape and with it, has accelerated the shift to streamed media,” said Matt Spiegel, executive vice president and head of the marketing solutions and media verticals at TransUnion. “To gain market share, platforms are vying for captive audiences, focusing on how their content can stand out in a growing sea of choices. We can expect factors like content quality, price, and user experience to all carry weight in decisions from consumers about streaming new content through various service providers.”

“COVID-19 has upended the entertainment landscape and with it, has accelerated the shift to streamed media,” said Matt Spiegel, executive vice president and head of the marketing solutions and media verticals at TransUnion. “To gain market share, platforms are vying for captive audiences, focusing on how their content can stand out in a growing sea of choices. We can expect factors like content quality, price, and user experience to all carry weight in decisions from consumers about streaming new content through various service providers.”

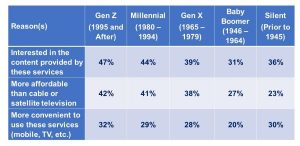

With traditional broadcast programming feeling the pinch in the wake of the pandemic, consumers are finding the diversity of content available on steaming platforms even more appealing. Across generations, content was the top reason consumers gravitated toward streaming services, greater than both affordability and convenience.

The younger generations (Gen Z and Millennials) were most likely to also use streaming services due to affordability concerns with traditional cable or satellite packages – a sign that the cord-cutting trend may continue in the new year. Overall, 68% of respondents will consider adding more streaming services in 2021 if the service is more cost effective than cable or satellite television, or if the platform has content the consumer is interested in.

Top Reason(s) for Using More Streaming Services in 2021 by Generation

*Survey respondents selected all that applied.

Despite increased competition among streaming services, the number of platforms in which consumers have subscriptions may have hit a plateau. Approximately 44% of consumers are currently subscribing to an average of 3-5 paid streaming services, whereas only 7% are subscribing to as many as 7-10. In the next 30-60 days, 58% of consumers cited they do not plan to add any new streaming services, however 67% said they also do not plan to cancel any of their existing subscriptions.

“The streaming wars have entered a new phase where it is not only about capturing potential new customers, but there’s also a focus on sustaining and maintaining their existing customer base. While consumers are adjusting to the new realities brought on by the pandemic, there is still a strong appetite for streaming. As those preferences persist, the advertising industry will need to connect the dots and create a better, more accurate view into the devices and people consuming streaming media in the connected home,” said Spiegel.

TransUnion’s suite of identity, audience and insights solutions help marketers and media companies understand and reach the consumers on the other side of the screen. To learn more, please visit https://www.transunion.com/media-consumption-nov2020.

About the Survey

The online survey was conducted the week of November 2, 2020 and included responses from 2,538 U.S. consumers, ages 18 and over.

The online survey was conducted the week of November 2, 2020 and included responses from 2,538 U.S. consumers, ages 18 and over.

Source: TransUnion Press Release