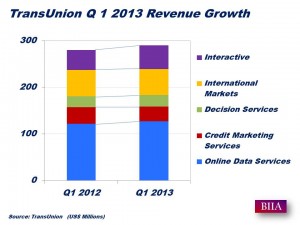

TransUnion reported revenue of $290.5 million, an increase of 3.5% compared to the first quarter of 2012.

TransUnion reported revenue of $290.5 million, an increase of 3.5% compared to the first quarter of 2012.

Operating income of $44.2 million in the first quarter, compared to $65.6 million in the prior year, was negatively impacted by a $23.4 million increase in depreciation and amortization, resulting primarily from purchase accounting adjustments to record tangible and intangibles assets at fair value due to the acquisition of TransUnion Corp. by TransUnion Holding on April 30, 2012 (the acquisition and related transactions being referred to herein as the “2012 Change in Control Transaction”). Excluding depreciation and amortization, operating income increased 2.3% compared to the first quarter of 2012, while the Company continued to invest in new initiatives to drive long-term growth.

Non-operating expense was $50.1 million in the first quarter of 2013 compared to $41.7 million in the prior year due to an increase in interest expense related primarily to the issuance of $600 million and $400 million principal amount of senior unsecured PIK toggle notes in the first and fourth quarters of 2012, respectively. Higher interest expense and the purchase accounting depreciation and amortization contributed to the net loss attributable to the Company of $6.3 million compared to net income of $1.7 million in the first quarter of 2012.

“In the first quarter we generated organic constant currency growth, versus a particularly strong first quarter of 2012, while continuing to invest in long-term growth initiatives,” said Jim Peck, the Company’s president and chief executive officer. “In my first quarter at TransUnion, I’ve found a company abundant with potential. We will further unlock this potential by continuing to identify, pursue and invest in organic growth initiatives that will drive long-term growth and value creation.”

Source: Yahoo Finance

For further information please log on!