TransUnion Announces Strong First Quarter 2022 Results and Enhances Unique Data Assets with Verisk Financial Services Acquisition

Outperformed first quarter revenue guidance driven by market-leading growth in U.S. Markets and International; delivered 32 percent total revenue growth and 13 percent organic constant currency revenue growth, excluding U.S. mortgage impact.

- Integrating Neustar and Sontiq successfully, posting strong organic growth, growing sales pipeline, cost reduction plans on track, and receiving positive customer feedback on long-term investment thesis.

- Completed the acquisition of Verisk Financial Services on April 8, 2022, and intend to retain the leading core businesses of Argus and Commerce Signals and divest the other businesses.

- Raising 2022 revenue guidance. We now expect 10% to 12% organic revenue growth, excluding U.S. mortgage impact, more than offsetting negative impact of the subsiding mortgage market.

TransUnion’s first quarter 2022 results incorporate Neustar into the Emerging Verticals of our U.S. Markets segment, and Sontiq into its Consumer Interactive segment. The Healthcare business, which was sold in December 2021, is reflected as a discontinued operation, net of tax, for all periods presented.

First Quarter 2022 Results

Revenue:

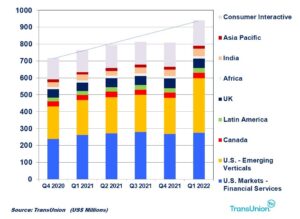

- Total revenue for the quarter, was $921 million, an increase of 32 percent (32 percent on a constant currency basis and 8 percent on an organic constant currency basis), compared with the first quarter of 2021.

Earnings:

- Net income attributable to TransUnion was $48 million for the quarter, compared with $128 million for the first quarter of 2021. Diluted earnings per share was $0.25, compared with $0.66 in the first quarter of 2021. Our first quarter 2022 net income attributable to TransUnion and diluted earnings per share were impacted by a significant expense of $30 million, with no offsetting tax benefit, for the regulatory matter described in “Legal Proceedings Update” below.

- Adjusted Net Income was $179 million for the quarter, compared with $160 million for the first quarter of 2021. Adjusted Diluted Earnings per Share for the quarter was $0.93, compared with $0.83 in the first quarter of 2021.

- Adjusted EBITDA was $334 million for the quarter, an increase of 20 percent (21 percent on a constant currency basis, 5 percent on an organic constant currency basis) compared with the first quarter of 2021. Adjusted EBITDA margin was 36.3 percent, compared with 39.7 percent in the first quarter of 2021.

“TransUnion delivered another strong quarter of market-leading, diversified growth. We drove strong performance in key verticals such as Financial Services, Insurance and Media; and delivered robust results internationally led by India, Latin America and Asia Pacific. Supported by this momentum and a financially healthy consumer, we are raising our 2022 organic growth expectations, with non-mortgage performance more than offsetting an expected 25% decline in U.S. mortgage revenues due to 30% inquiry declines,” said Chris Cartwright, President and CEO. “We delivered early successes in integrating Neustar and Sontiq, with strong growth, on-track cost savings and significant customer interest supporting our long-term growth plans.”

“TransUnion delivered another strong quarter of market-leading, diversified growth. We drove strong performance in key verticals such as Financial Services, Insurance and Media; and delivered robust results internationally led by India, Latin America and Asia Pacific. Supported by this momentum and a financially healthy consumer, we are raising our 2022 organic growth expectations, with non-mortgage performance more than offsetting an expected 25% decline in U.S. mortgage revenues due to 30% inquiry declines,” said Chris Cartwright, President and CEO. “We delivered early successes in integrating Neustar and Sontiq, with strong growth, on-track cost savings and significant customer interest supporting our long-term growth plans.”

“Additionally, we completed the acquisition of Verisk Financial Services, and intend to retain the leading Argus and Commerce Signals businesses and divest the other businesses. This decision will focus our energy on enhancing and growing the core Argus asset while allowing the other businesses to benefit from new ownership.”

“These transformative acquisitions enhance our capabilities across high-growth and complementary credit, marketing and fraud markets. Our solutions have never been more relevant, helping businesses navigate an increasingly digital world, and ensuring that consumers around the world access the opportunities that lead to a higher quality of life. This supports our confidence in delivering the 2025 long-term financial targets laid out at our March 2022 Investor Day, which included greater than $5 billion revenue, greater than $2 billion Adjusted EBITDA, and greater than $6.00 Adjusted Diluted Earnings per Share.”

First Quarter 2022 Segment Results

U.S. Markets revenue was $600 million, an increase of 42 percent (7 percent on an organic basis) compared with the first quarter of 2021.

- Financial Services revenue was $276 million, an increase of 5 percent compared with the first quarter of 2021.

- Emerging Verticals revenue, which includes Neustar, Insurance and all other verticals, was $323 million, an increase of 104 percent (10 percent on an organic basis) compared with the first quarter of 2021.

Adjusted EBITDA was $217 million, an increase of 23 percent (2 percent on an organic basis) compared with the first quarter of 2021.

International revenue was $191 million, an increase of 15 percent (18 percent on a constant currency basis) compared with the first quarter of 2021.

- Canada revenue was $31 million, an increase of 1 percent (1 percent on a constant currency basis) compared with the first quarter of 2021.

- Latin America revenue was $27 million, an increase of 13 percent (17 percent on a constant currency basis) compared with the first quarter of 2021.

- United Kingdom revenue was $56 million, an increase of 12 percent (15 percent on a constant currency basis) compared with the first quarter of 2020.

- Africa revenue was $15 million, an increase of 8 percent (9 percent on a constant currency basis) compared with the first quarter of 2021.

- India revenue was $45 million, an increase of 33 percent (37 percent on a constant currency basis) compared with the first quarter of 2021.

- Asia Pacific revenue was $17 million, an increase of 23 percent (25 percent on a constant currency basis) compared with the first quarter of 2021.

International’s Adjusted EBITDA was $82 million, an increase of 15 percent (18 percent on a constant currency basis) compared with the first quarter of 2021.

Consumer Interactive Rrevenue, which includes Sontiq, was $150 million, an increase of 15 percent (a decrease of 3 percent on an organic basis) compared with the first quarter of 2021.

Adjusted EBITDA was $69 million, an increase of 18 percent (5 percent on an organic basis) compared with the first quarter of 2021.

Recently Completed Transaction

Verisk Financial Services Acquisition

On April 8, 2022, we closed on our previously announced agreement to acquire Verisk Financial Services, the financial services business unit of Verisk Analytics, Inc., including its leading core businesses of Argus Information and Advisory Services, Inc. and Commerce Signals, Inc. We acquired 100% of the outstanding equity of the entities that comprise the financial services business unit for approximately $515 million, funded with cash on hand, and subject to certain customary purchase price adjustments. For additional information on this acquisition, refer to our Press Release dated April 8, 2022, which is available on our Investor Relations website at https://newsroom.transunion.com.

We will retain the leading core businesses of Verisk Financial Services, and plan to divest the other businesses. The results of operations of the core businesses will be included in our U.S. Markets reportable segment from the date of acquisition. We will classify the net assets of  the other businesses as held-for-sale, and the operations of those businesses as discontinued operations, as of the date of acquisition.

the other businesses as held-for-sale, and the operations of those businesses as discontinued operations, as of the date of acquisition.

Source: TransUnion Earnings Release