Global information and insights company TransUnion has reported an 18% increase in digital fraud attempts in Hong Kong and 80% globally from pre-pandemic levels.

TransUnion released a 2023 State of Omnichannel Fraud Report that combines proprietary insights from its global intelligence network and a specially commissioned consumer survey throughout 18 countries and regions worldwide to examine fraud trends and prevention strategies to enable trust in the current omnichannel marketplace.

TransUnion’s report findings on digital fraud attempts

Globally, the study showcased that 4.6% of digital transactions analysed were potentially fraudulent in 2022, similar to the rate seen in 2019. However, despite an easing of the digital fraud rate back to the 2019 level, the global volume of digital fraud attempts increased by 80% from 2019 to 2022, together with an increase in digital transactions throughout the same period.

In Hong Kong, throughout 2022 17.5% of digital transactions were suspected to be fraudulent, the highest amongst the regions studied. The volume generally mirrored the global uptrend, with an 18% increase in digital fraud attempts originating from Hong Kong, compared to pre-pandemic 2019.

Jerry Ying, chief product officer at TransUnion Asia Pacific stated that the increase in digital transactions following the pandemic results in higher risk facing consumers and businesses alike. As per their statement, as cybercriminals and fraudsters are increasingly sophisticated, businesses should ensure robust fraud prevention measures to build consumer trust and protect their online experiences across digital channels.

Jerry Ying, chief product officer at TransUnion Asia Pacific stated that the increase in digital transactions following the pandemic results in higher risk facing consumers and businesses alike. As per their statement, as cybercriminals and fraudsters are increasingly sophisticated, businesses should ensure robust fraud prevention measures to build consumer trust and protect their online experiences across digital channels.

Source: TransUnion TruValidate

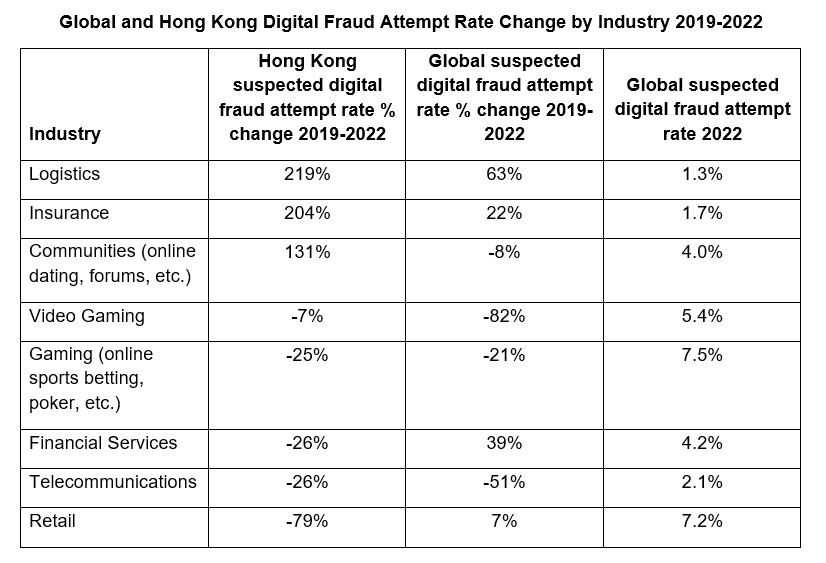

Globally in 2022, the gaming (online sports, betting etc) and retail industries saw the suspected digital fraud rate at 7.5% and 7.2%, respectively, followed by video gaming at 5.4%, financial services at 4.2%, and communities (online dating, forums) at 4.0%.

For transactions originating from Hong Kong, the logistics industry had the highest growth rate, up by 219% from 2019 to 2022, followed by the insurance and communities industries, which saw an increase in digital fraud attempts from the region over the same period, up 204% and 131%, respectively.

Study findings showcase an increased percentage of people to be impacted by digital fraud attempts across communications channels, with 52% of those surveyed globally stating they were targeted via email, online, phone call, or text messaging in the three months beginning September 2022. Amongst Hong Kong-based respondents, 45% confirmed being targeted by such attempts, whereas 5% fell victim during this period. Phishing was the most reported fraud scheme experienced by Hong Kong consumers, standing at 38%, followed by stolen credit cards at 27%, and vishing (fraudulent phone calls that induce the disclosure of personal information) at 22%.

Source: thepaypers.com