The 4th quarter earnings reports are becoming available one by one. We expect the remainder to become available in due course.

The 4th quarter earnings reports are becoming available one by one. We expect the remainder to become available in due course.

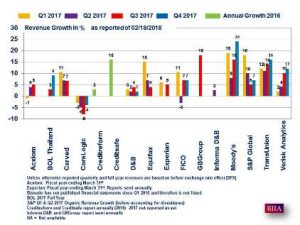

The rating agencies are once again leading the revenue growth charts. Remember, following the financial crisis some people already had written them off. Others who had set their sights on analytics are also doing well. Those who live in single digit growth market niches made up of data businesses like Acxiom, D&B and Thomson Reuters Risk live on shaky ground. So why are they not growing?

Anthea Stratigos in her recent article on LinkedIn “5 lessons from D&B, Thomson Reuters, Informa, Gartner and other industry stalwarts” puts the finger on the problem. The data businesses operate in mature markets and cannot be propelled to higher growth relying on organic growth alone; neither can it be done with financial engineering. To achieve 10% growth in most of our industry’s sectors requires inorganic growth. If you take note of Verisk Analytics, it is making one acquisition after another.

As Verisk Analytics and Moody’s show, value added is key. However, as Anthea Stratigos points out, owners and boards often have unrealistic expectations, and neither want to acknowledge that transformation is expensive and time-consuming.

Source: Anthea Stratigos on LinkedIn Growth Chart: BIIA