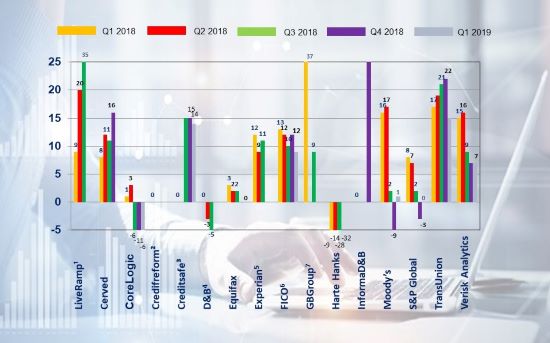

As of May 15th, all major credit bureaus and information companies have reported Q1 2019 results.

Equifax suffers from the fallout of the data breach of 2017 its revenue growth rate is down 2%. In conjunction with the 2017 date breach Equifax took a $690 million charge in Q1 that includes its estimate of losses it expects to incur in connection with a potential global resolution of the consumer class action cases and the investigations by certain federal and state regulators. Since the announcement of the cybersecurity incident in September 2017, Equifax has incurred a total of $1,352.0 million of costs related to the incident, incremental technology and data security costs, and an accrual for losses associated with legal proceedings and investigations related to the 2017 cybersecurity incident.

Experian reported 9% growth (constant currency) for the fiscal year ending March 31st, 2019. Its US business grew 11%; Latin America 6%; UK and Ireland grew 4% and EMEA / Asia Pacific grew 9%.

Companies which are making acquisitions show the highest growth rates: LiveRamp, Cerved, TransUnion and Verisk Analytics.

TransUnion’s double-digit growth rate continues to be buoyed by acquisitions made in the prior year. TransUnion has become one of the most acquisitive credit bureaus having made 9 acquisitions in the past two years resulting in double digit revenue growth for every quarter in 2018. Noteworthy are its acquisitions of iovation (identity and fraud management) and Callcredit. In addition TransUnion has made strategic investments in Fintech companies:

Payfone, an award-winning digital identity authentication leader, has announced the closing of a $24 million funding round led by TransUnion (NYSE: TRU), a global leader in information solutions, with participation from existing investors Synchrony (NYSE: SYF), a premier consumer financial services company and others. TransUnion’s investment in Payfone underscores a new strategic partnership that will leverage the two companies’ complementary missions and capabilities to accelerate the global digital economy.

Dashlane, a popular password manager and all-round identity management solution, has raised another $30 million in funding, the company announced. The funding — this time a round of debt financing from Hercules Capital — follows prior investment from FirstMark Capital, Rho Ventures, Bessemer Venture Partners, TransUnion and Silicon Valley Bank.

Tru Optik, the leader in over-the-top (OTT) targeting, measurement, and privacy management, announced the close of a $10 million venture round led by Mithera Capital. Additional investors in the round include TransUnion, Connecticut Innovations, Arab Angel Fund, and Progress Ventures.

Verisk Analytics made 8 acquisitions in the past two years concentrating on data and analytical solutions in niche markets to boost insights of every conceivable risk sector. D&B has been taken private and no longer discloses company results.

Creditsafe and FICO continue to produce double digit growth rates while rating agencies are pummeled by a sharp decline in new bond issues reversing the growth trend of previous quarters. Notwithstanding the decline in rating revenues, all rating agencies analytical services continue to produce mid to high single digit growth rates.

Moody’s and S&P Global consolidated revenues were flat. Both of the respective rating segments were still in negative growth territory. Moody’s Rating segment was down 7%, however its analytics segment grew by 16%. S&P Global’s rating segment was also down 7%. Its market intelligence business (includes analytics) was up 10%.

Business information provider Dun & Bradstreet was taken private early this year and does no longer release quarterly financial statements.

Source: Company Press Releases.