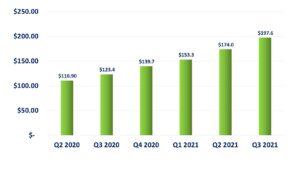

Buoyed by acquisitions ZoomInfo reported GAAP Revenue of $197.6 million. GAAP Operating Margin of 10% and Adjusted Operating Income Margin of 39%. Cash Flow from Operations of $46.5 million and Unlevered Free Cash Flow of $73.3 million

“ZoomInfo delivered exceptional results, with another quarter of accelerating revenue growth, and strong free cash flow  generation,” said Henry Schuck, ZoomInfo Founder and CEO. “We continue to execute across all areas of the business as we build a category defining company by delivering end-to-end success for go-to-market teams worldwide.”

generation,” said Henry Schuck, ZoomInfo Founder and CEO. “We continue to execute across all areas of the business as we build a category defining company by delivering end-to-end success for go-to-market teams worldwide.”

Third Quarter 2021 Financial and Other Recent Highlights –

Revenue of $197.6 million, an increase of 60% year-over-year. Operating income of $20.2 million and Adjusted Operating Income of $78.4 million. GAAP operating income margin of 10% and Adjusted Operating Income Margin of 39%. Cash flow from operations of $46.5 million and Unlevered Free Cash Flow of $73.3 million.

Business and Operating Highlights:

Acquired RingLead, a leading provider of data orchestration and revenue operations automation that further connects the intelligence and engagement layers of the ZoomInfo platform, empowering customers to seamlessly manage their data across systems. The acquisition was announced and closed in September 2021.

After the acquisition in July, the company announced its first integrations with Chorus.ai and the ZoomInfo platform in September, allowing customers to transcribe and analyze calls taken in ZoomInfo Engage, access Chorus’ Momentum Insights within the ZoomInfo platform, and unlock ZoomInfo’s business-to-business data and insights for the Chorus offering.

Received multiple awards that recognize the company for career growth, company leadership, diversity and inclusivity impact. ZoomInfo founder and CEO Henry Schuck appeared on the list of Best CEOs for diversity, ZoomInfo was named to the 2021 Fortune Best Workplaces for Millennials List and was recognized by the Mass Technology Leadership Council as a top company for Inclusivity Impact.

Received multiple awards that recognize the company for career growth, company leadership, diversity and inclusivity impact. ZoomInfo founder and CEO Henry Schuck appeared on the list of Best CEOs for diversity, ZoomInfo was named to the 2021 Fortune Best Workplaces for Millennials List and was recognized by the Mass Technology Leadership Council as a top company for Inclusivity Impact.

Announced that ZoomInfo’s board of directors unanimously approved the elimination of the UP-C corporate structure and move to a single class of common stock, with one share per vote. Consistent with the Company’s plans, the conversion to a single class of common stock has been completed in the fourth quarter of 2021.

Closed the quarter with more than 25,000 customers, and more than 1,250 customers with $100,000 or greater in  annual contract value.

annual contract value.

Source: Company Earnings Release

![Salesforce Q4 2024 Revenue Up 11%, FY Up 11% [Fiscal Year Ended January 31, 2024]](https://www.biia.com/wp-content/uploads/2024/03/Salesforce-Fiscal-2024-Fin-Results-ended-Jan31-2024-440x264.jpg)