Alibaba Enters B2B Credit Reporting: Partners with Banks, Agencies to Introduce B2B Financing and Rating Services

Alibaba founder Jack Ma Yun (fifth from left) is shown attending the opening ceremony of MYbank in Hangzhou, Zhejiang Province last June 25. MYbank had a registered capital of 4 billion yuan (US$655 million) and was created to focus on providing financial services for small- and micro -businesses, as well as online consumers. Photo: Xinhua

Alibaba founder Jack Ma Yun (fifth from left) is shown attending the opening ceremony of MYbank in Hangzhou, Zhejiang Province last June 25. MYbank had a registered capital of 4 billion yuan (US$655 million) and was created to focus on providing financial services for small- and micro -businesses, as well as online consumers. Photo: Xinhua

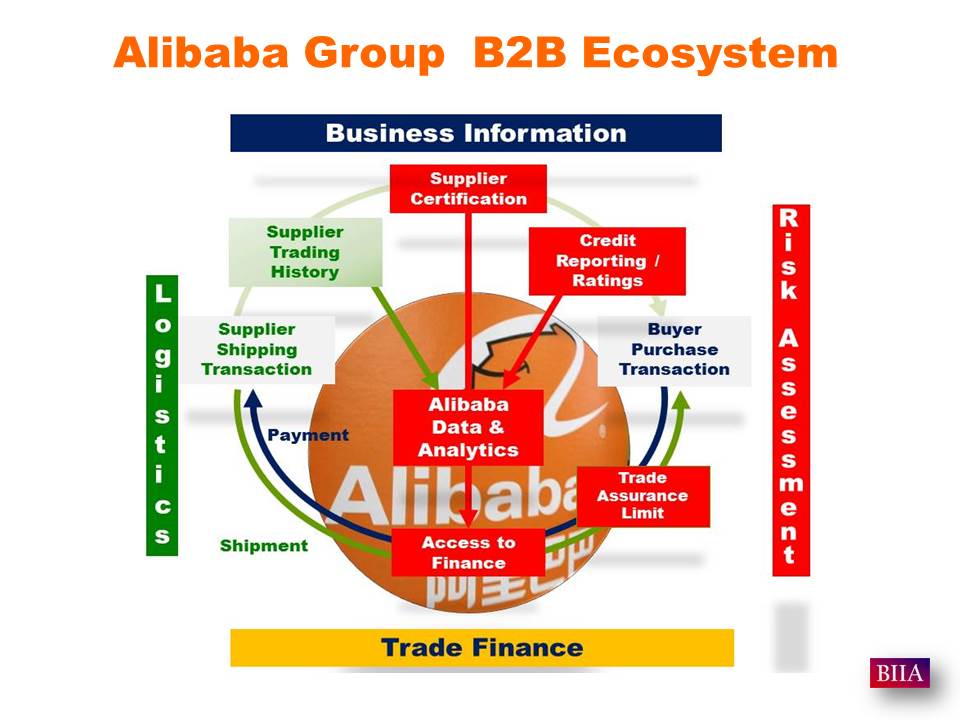

The importance of an e-commerce ecosystem: Credit Reporting/Rating, SME Financing, Credit Guarantees, Supplier Certification, Payment Services and Logistics

The move comes as the company continues to ramp up its business-to-business (B2B) ecosystem globally by cooperating with offline industries. By building up the credit profiles of Chinese SMEs based on business-related data, Alibaba.com’s credit reporting service can help overseas buyers identify trustworthy trading partners and provide Chinese suppliers access to innovative financing options.

Alibaba’s online platform evolved from a directory of Chinese suppliers to a one-stop platform providing a variety of services for international buyers and suppliers, including logistics and business verification services.

“To Alibaba, regardless of B2B exports or imports, the ecosystem is very important. The Alibaba mission is to make it easy to do any type of business,” Alibaba Group CEO Daniel Zhang said at a conference Tuesday in Hangzhou, Zhejiang province. The group is headquartered in this affluent city in East China, also the birthplace of founder and chairman Jack Ma Yun. Mainland Chinese partners for Alibaba’s latest initiative to finance SMEs include Alibaba-backed internet bank MYBank, as well as Bank of China and China Merchants Bank.

“To Alibaba, regardless of B2B exports or imports, the ecosystem is very important. The Alibaba mission is to make it easy to do any type of business,” Alibaba Group CEO Daniel Zhang said at a conference Tuesday in Hangzhou, Zhejiang province. The group is headquartered in this affluent city in East China, also the birthplace of founder and chairman Jack Ma Yun. Mainland Chinese partners for Alibaba’s latest initiative to finance SMEs include Alibaba-backed internet bank MYBank, as well as Bank of China and China Merchants Bank.

Currently, only Chinese SMEs are able to take out loans from Alibaba to fund cross-border trades. Alibaba aims to launch its own rating platform (credit.alibaba.com) later this year. It said it will rate Chinese suppliers who join the platform. Credit ratings are determined by an analysis of Alibaba’s big data, public records and ratings from traditional credit scoring firms.

“By building up the credit profiles of Chinese SMEs based on business-related data, Alibaba.com’s credit reporting service can help overseas buyers identify trustworthy trading partners and provide Chinese suppliers access to innovative financing options,” said Sophie Wu, president of Alibaba’s B2B business unit.

“By building up the credit profiles of Chinese SMEs based on business-related data, Alibaba.com’s credit reporting service can help overseas buyers identify trustworthy trading partners and provide Chinese suppliers access to innovative financing options,” said Sophie Wu, president of Alibaba’s B2B business unit.

Over the last year, Alibaba has implemented a number of initiatives to create a more robust ecosystem. In July, a trade assurance program was implemented to give buyers coverage on their purchases on Alibaba. Should a buyer find quality issues with the goods, or receive a shipment late, they are entitled to a full refund. The company also works with different shipping companies to provide logistics solutions to buyers who use the Alibaba platform.

In December, Alibaba inked a deal with tradeshow giant UBM, where both companies will combine their online and offline strengths to develop an online platform to help connect buyers and suppliers at trade fairs.

Source: SCMP.com