SBI Ripple Asia has formed a consortium with so me Japanese credit card companies to utilize blockchain technology. Called the Credit Card Industry Consortium, the group will be formally established in January.

me Japanese credit card companies to utilize blockchain technology. Called the Credit Card Industry Consortium, the group will be formally established in January.

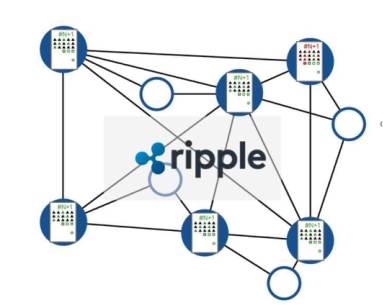

Formed in 2016, SBI Ripple Asia is the Asia-Pacific partnership of Japanese financial services company SBI Holdings and FinTech payments firm Ripple. It manages a consortium of more than 60 Japanese banks who leverage Ripple’s enterprise blockchain technology for instant payments and settlement.

SBI Ripple Asia said it has entered into partnership agreement with some of the leading Japanese credit card companies, including JCB, Sumitomo Mitsui Card, and Credit Saison. The Credit Card Industry Consortium aims to research cross-industry, cutting-edge technology, and establish a common foundation for the use of blockchain technology. It has already developed a new payment app that tapped Ripple’s technology to enable nearly instantaneous funding transactions without compromising user security or control.

“Distributed ledger technology (DLT) has the potential to enhance the stability, flexibility and efficiency of financial institution systems.” SBI Ripple Asia said. “In the card industry, it is expected to be utilized in various applications such as identity verification, sharing/fraud prevention of illegal transactions, and single sign-on.”

Today the world sends more than $155 trillion* across borders. Yet, the underlying infrastructure is dated and flawed. Ripple connects banks, payment providers and digital asset exchanges via RippleNet to provide one frictionless experience to send money globally. For details view Ripple Use Cases.

Source : BlockTribune / Financial Magnates