Centrix is New Zealand’s credit bureau. Every month Centrix releases the Credit Indicator Report which analyses New Zealand’s credit data, focusing on emerging trends and their possible impacts. This report is valuable for gaining an understanding of the current economic climate and consumer confidence. We are delighted to be able to share it with you and hope you find it insightful.

March highlights are as follows:

- Financial hardship is up 7% on last month with 60% of new financial hardship cases related to difficulties in making home loan repayments.

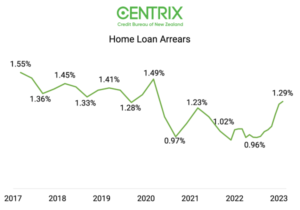

- Mortgage arrears are up for the 7th month in a row, out of line with the usual seasonal trend. New mortgage lending is down 42% on last year as recent weather events and the market downturn take their toll.

- Consumer credit demand has strengthened in recent weeks, up 3% year-on-year, while Buy Now Pay Later new customer enquiries are at their lowest since 2017.

- Construction companies are twice as likely to fail than the typical NZ business, accounting for 26% of all company liquidations in the last year.

This week, the Reserve Bank of New Zealand will be making the latest Monetary Policy Review announcement, including any further changes to the Official Cash Rate (OCR).

In February, the OCR was lifted to 4.75% in the Reserve Bank’s ongoing battle to slow inflation. This resulted in rising interest rates for most Kiwi households across the board.

In February, the OCR was lifted to 4.75% in the Reserve Bank’s ongoing battle to slow inflation. This resulted in rising interest rates for most Kiwi households across the board.

Coupled with fixed rate home loans rolling off and having to commit to higher repayments, the cost-of-living squeeze continues to impact many households nationwide.

Our latest data shows mortgage arrears climbing for the seventh consecutive month, which could point to many being unable to service these higher mortgage rates – a difficult situation for anyone to be in.

Overall arrears (for all consumer related products) softened slightly this month compared to January, aligning to seasonal trends. There is an increase when comparing year on year, but overall arrears still remain below pre-covid levels.

Consumer credit demand strengthened in March 2023 due to upswings in credit cards, personal and vehicle loans. However, demand for both mortgages and BNPL remains down, with new customer enquiries for the latter reaching the lowest level recorded since July 2017.

Looking at unsecured personal loan demand, there are nearly 330,000 New Zealanders who currently have unsecured personal loan debt, of which there are over 60,000 borrowers holding multiple personal loans.

Turning to business credit trends, demand is down year-on-year, but appears to be climbing month-on-month, spurred on by the transport and construction sectors.

Turning to business credit trends, demand is down year-on-year, but appears to be climbing month-on-month, spurred on by the transport and construction sectors.

The construction sector continues to be disrupted by uncertainty due to rising defaults as an increasing number of companies collapse.

For anyone struggling to make ends meet financially, it’s important to minimise the long-term impact of these challenging times.

Now’s the time to speak to your credit provider or seek the advice of a financial expert and plan for repayment obligations to avoid financial trouble in the future.

Keith McLaughlin

Managing Director

Source: Centrix – To read the full report click on this link: Centrix Credit Indicator Report_March 2023