FICO (NYSE:FICO), a leading applied analytics company, has announced results for its fourth fiscal quarter ended September 30, 2021.

- Net income for the quarter totaled $85.7 million, or $3.00 per share, versus $59.1 million, or $1.98 per share, in the prior year period.

- Net cash provided by operating activities for the quarter was $91.8 million versus $136.2 million in the prior year period.

Fourth Quarter Fiscal 2021 Non-GAAP Results

Non-GAAP Net Income for the quarter was $111.9 million versus $97.0 million in the prior year period. Non-GAAP EPS for the quarter was $3.92 versus $3.25 in the prior year period. Free cash flow was $90.0 million for the current quarter versus $135.3 million in the prior year period. The Non-GAAP financial measures are described in the financial table captioned “Non-GAAP Results” and are reconciled to the corresponding GAAP results in the financial tables at the end of this release.

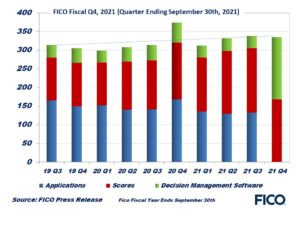

Fourth Quarter Fiscal 2021 GAAP Revenue

The company reported revenues of $334.6 million for the quarter as compared to $374.4 million reported in the prior year period.

“We had a strong finish to another great year,” said Will Lansing, chief executive officer. “We are increasing our transparency around our software business, providing additional subscription metrics.”

The company changed its reporting segments, merging its legacy Applications and Decision Management Software segments into a new Software segment, and retaining its Scores segment. Revenues for the fourth quarter of fiscal 2021 across the company’s two operating segments were as follows:

- Software revenues, which include the company’s analytics and digital decisioning technology, were $166.0 million in the fourth quarter, compared to $221.7 million in the prior year period, a decrease of 25%, primarily due to a reduction in up-front recognition of term license revenues for on-premises software sales, the sale of the Debt Collections and Recovery product line in early June, and a decline in professional services. Year-over-year, Software Annual Recurring Revenue (ARR) was up 7% year over year, consisting of 58% Platform ARR growth and 1% non-Platform growth. Software Dollar-Based Net Retention Rate was 106% year-over-year, with Platform Solutions at 143% and Non-Platform Solutions at 100%.

- Scores revenues, which include the company’s business-to-business (B2B) scoring solutions, and business-to-consumer (B2C) solutions, were $168.6 million in the fourth quarter, an increase of 10% compared to $152.7 million in the prior year period which included a one-time royalty true-up. B2B revenue increased 2%, driven largely by unit price increases and volumes, partially offset by the non-recurring prior year true-up. B2C revenue increased 32% from the prior year period due to higher volumes at myFICO.com, as well as through our partners.

Source: FICO Earnings Release

Source: FICO Earnings Release