Australian business attitudes are upbeat as we head into the year-end. According to Dun & Bradstreet’s September Business Expectations Survey, companies are anticipating increased sales, profits, employee numbers and selling prices in the December quarter, compared to the September quarter. However, compared to the final quarter of 2015, expectations are lower across in all components of the survey.

Australian business attitudes are upbeat as we head into the year-end. According to Dun & Bradstreet’s September Business Expectations Survey, companies are anticipating increased sales, profits, employee numbers and selling prices in the December quarter, compared to the September quarter. However, compared to the final quarter of 2015, expectations are lower across in all components of the survey.

Stephen Koukoulas, Economics Advisor to Dun & Bradstreet, said: “The generally positive tone to business expectations has continued, which points to an on-going solid pace of expansion for the economy over the remainder of 2016. The upswing for expected sales, profits and employment has been sustained in the most recent survey, aided, it would appear, by the record low interest rate settings and evidence of policy progress from the re-elected Turnbull government.”

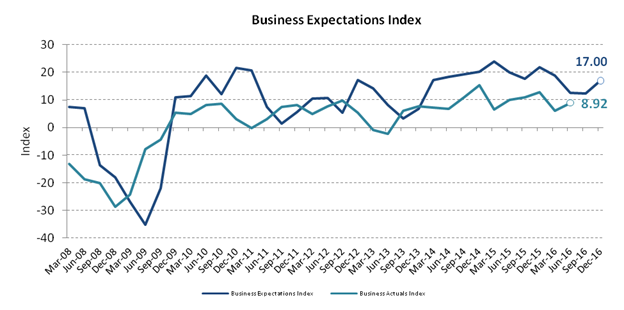

Dun & Bradstreet’s Business Expectations Index, the average of the survey’s measures of Sales, Profits, Employment and Capital Investment, has jumped 37.1% to 17.0 points for the fourth quarter of 2016, up from 12.4 points for Q3 2016, but down 22.0% from 21.8 points in Q4 2015. The final Q4 result is 9.1 points above the 10-year average of 7.9 points.

The Business Expectations Index is an aggregate of the survey’s

measures of sales, profits employment and investment expectations.

“Expectations for capital investment remain subdued, which is a concern for the economy given the still unfolding decline in mining investment plans,” Mr Koukoulas added. The Capital Investment Expectations Index was the only index which saw a decline for the December quarter compared to the September quarter, with the index falling 23.3% from 10.3 points to 7.9 points. Year-on-year, the index dropped 33.6%.

“The ongoing weakness in expected selling prices is consistent with the near record low inflation rate that has been evident in recent quarters, and suggests that official interest rates will remain very low, at least in the near term,” Mr Koukoulas noted.

The Retail industry returned especially strong scores when looking ahead to the holiday period, with retailers expecting higher sales, employee numbers, profits and capital investment in the December quarter. The uptick in expectations follows three consecutive quarters of declining expectations among Retail businesses. Most notably, the Employment Expectations Index for the Retail sector leapt from 0.2 points to 12.4 points. The Selling Prices Expectations Index fell, sliding 50.3% from 17.3 points to 8.6 points which is consistent with discounting in the sector. Compared to the corresponding quarter in 2015, expectations for all components (Sales, Profits, Employment, Capital Investment and Selling Prices) were lower.

About the Business Expectations Survey

Dun & Bradstreet’s Business Expectations Survey is the only monthly survey to provide a comprehensive summary of key economic and financial conditions in Australia six months ahead of the latest quarterly national income accounts. The survey’s unique forecasting ability supports Dun & Bradstreet’s ongoing efforts to support business leaders, policy makers and commentators in responding to the changing dynamics of the Australian economy.

Since March 1988, a sample of Australian business executives is asked if they expect an increase, decrease or no change in their quarter-ahead sales, profits, employees, capital investment and selling prices compared with the same quarter a year ago. The executives are also asked for actual changes over the 12 months to the latest completed year.

In today’s report, the final index for the latest quarters are based on approximately 1,200 responses obtained during July, August and September 2016. The Business Expectations Survey is published on the first Tuesday of every month, with the next report due on 1 November 2016.

The latest Business Expectations Survey is available online, and includes a breakdown across key indexes, sectors and the issues most expected to influence Australian businesses.

For more information, please contact:

Bryony Duncan-Smith

+ 61 0498 086 246

To arrange an interview with Stephen Koukoulas, Economic Adviser to Dun & Bradstreet, please contact 0467 647 508 or stephen@thekouk.com (please note that Monday 3 October is a public holiday in the ACT).