How Businesses Made Decisions in 2023: By Cato Syverson, CEO of Creditsafe

2023 was the year that most businesses were banking on to fully spring back from the disruption of COVID years. But this comeback year was peppered with many challenges of its own – be it the threat of recession and record-high inflation or massive disruptions in supply chains and international markets due to the raging war in the Middle East and Ukraine.

Amid these faltering economies, shrunken budgets & cost cutbacks, most businesses took refuge in a risk-based approach to making major business moves in 2023. Looking back over the year we observed some of emerging trends in decision-making patterns within businesses, particularly regarding how they made decisions using data and automation for better risk management and gaining better visibility of their customers, suppliers and competitors. To dig deeper into our findings, we sat down with some of the top, experienced voices in data intelligence at Creditsafe to reflect on them.

Automated decision-making is now a ‘must-have’ for sales as well as finance functions

Automated decision-making is now a ‘must-have’ for sales as well as finance functions

In a landscape where business leaders across various departments want to cut through siloes, companies that are powered by interconnected data-driven decisions across all functions are primed to swiftly outpace competitors.

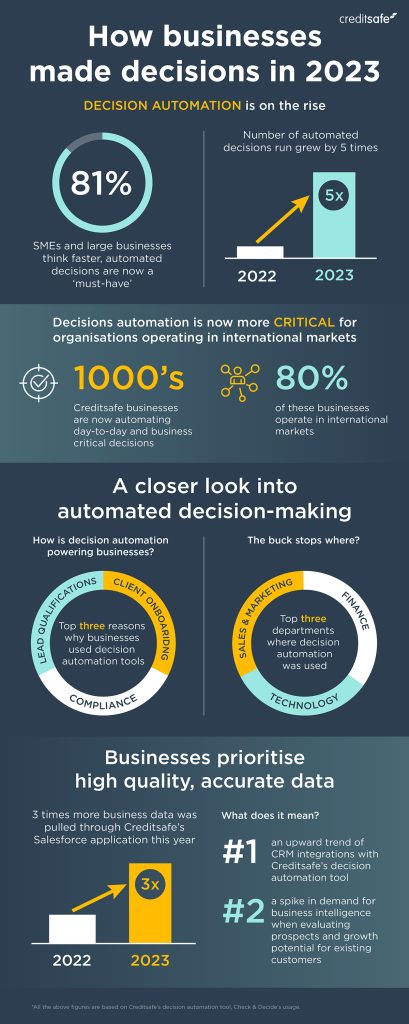

According to usage statistics of Creditsafe’s decision automation tool, Check & Decide, we found some groundbreaking insights that show how data-driven decision-making evolved within businesses in 2023:

- Using decision automation outside of credit control and finance: Making faster, informed, data-driven decisions is no longer just a priority for credit control departments. We found that functions like sales and customer success are regularly using automation to speed up and drive consistency in their decisions across prospecting, lead qualifications, client onboarding and much more.

- Increasing importance of decision automation for businesses in international markets: We observed a five-fold increase in the number of decisions run by businesses operating in international markets. We attributed this trend to the high inflation, ongoing interest rate hikes and the uncertain economic outlook and how it has prompted many businesses to adopt a risk-based approach, particularly so when trading with foreign organisations where visibility of risk is much lower.

It shows how business leaders want to manage risk with precision and use more data to make a decision and hence, choose to use automation to avoid increasing time or complexities in processing data.

Kathryn Smith, Chief Product Officer, Creditsafe

Kathryn Smith, Chief Product Officer, Creditsafe

“This year we observed such a steady increase in many businesses demanding more high-quality data, not just in terms of the breadth of data coverage but also depth of it,” said Smith.

“Businesses want more autonomy in making decisions without the hassle and time consuming nature of mapping behaviour trends and data points. They want to simplify and expedite decisions, while making sure they’re accurate to the ‘T’”

“In 2024, we want to expand the application of Creditsafe’s decision automation tool, Check & Decide from just decision making to modelling and analysis; especially since decision automation has grown out of being traditionally used for credit control and finance to now prospecting, selling, client onboarding and much more.”

Businesses want more visibility into larger organisations & their influence

Gone are the days of big data being the be-all and end-all. 2023 was a clear sign that the needs of business leaders had tipped in favour of deep data, where quality trumps quantity. Businesses across the world have renewed their focus on enhancing their datasets to forecast trends, identify behavioural patterns and most importantly increase visibility into global business-to-business ownerships, relationships and connections also known as corporate linkages.

This spike in demand for better quality and coverage of data also comes at a time when we’ve observed a considerable increase in the usage of decision automation in businesses. This also indicates how companies across the world now want to lay a stronger foundation for automated decision making with high-quality, accurate data.

David Walters, Chief Data Officer, Creditsafe

David Walters, Chief Data Officer, Creditsafe

“Corporate group structures are important to understand the relationships, influence, and control among different companies within a larger organization. Understanding corporate group structures can help individuals make informed decisions and navigate interactions with these companies more effectively,” said Walters.

“It can also enable people to evaluate potential risks, opportunities, and dependencies associated with a particular company or industry. Additionally, understanding group structures can shed light on the organization’s overall strategy, ownership, governance, and financial performance.”

This year, Creditsafe enhanced its database in both coverage and quality:

- We deployed a new lineup of strong international data partners covering 38 more countries across South America, the Caribbean and even Australia, apart from enhancing data in countries across Europe, Asia, the Middle East and Oceania. We also have plans to onboard some additional, new data partners in Africa in 2024.

- With a continually growing data partner network, we increased the number of corporate linkages by an additional 1 million linkages and incorporated our partner network’s ownership data into our global group structure.

Decision automation is now driving customer experience

An often overlooked aspect of customer experience in B2B transaction is where one’s customer journey starts: client onboarding. Lengthy approval processes, tedious checks and due diligence often make onboarding processes slow, duplicative, and overly complex, causing potential customers to drop off or create significant dissatisfaction when coming on board.

In 2023, over three times more business data was pulled through the Creditsafe’s salesforce application for client onboarding, amongst other essential sales processes like Know-Your-Customer (KYC) checks. The growing trend of integrating customer relationship management systems (CRMs) with decision automation tools shows how important speed is becoming in securing new business, boosting satisfaction rates and shortening the time-to-value for clients and vendors alike.

Scott McConnell, Chief Sales and Marketing Officer, Creditsafe

Scott McConnell, Chief Sales and Marketing Officer, Creditsafe

“Using decision-automation to instantly onboard customers solves an age old problem in customer service,” said McConnell.

Throughout my career in sales, I’ve seen the same scenario unfold many times. Somewhere between KYC due diligence checks, account opening and payment file testing, an almost-customer will drop off or change their minds about signing up especially if they’ve been speaking to other vendors.

In 2024, we plan to introduce more nuanced ways to integrate decision automation into CRMs and sales automation tools to reduce the time of onboarding, upselling and other historically tedious processes in sales.”

Using AI and machine learning to power long-term, business-critical decisions

This year, we observed that companies are rapidly adopting AI to predict short-term consumer behaviour and maximise profits. But as we integrate AI and machine learning capabilities into our data cloud and decision automation products, we are realising that businesses could use the technology to take a long-term view of behavioural analytics and set customer-centric goals.

John Seery, Chief Technology Officer, Creditsafe

John Seery, Chief Technology Officer, Creditsafe

“2023 was an exciting year for technology given the advances in AI technologies. We kicked off several programs to explore the potential of AI in creating value for our clients from the incredible options available with AI” said Seery.

“Most businesses today are using AI to meet short term goals like cost reduction and revenue growth. However, using AI and machine learning in our decision automation tools means you can predict with reasonable accuracy which customers can have the best growth in 10 years’ time, therefore illuminating which ones to go after during prospecting. This way you’re prospecting for your own long-term growth.”

“As we enter 2024 we will fully embrace AI technologies and deploy new capabilities across the company.”

Does your business want to automate decisions in 2024?

Whether it’s gaining more visibility on suppliers, competitors or customers or introducing faster, easier prospecting and client onboarding for your sales teams, explore Creditsafe’s Check & Decide today to find out how to power lightning-fast decisions at your organization.