Consumer financial stress continues to ease this year as Australians maintain a focus on shoring-up their financial position in the aftermath of the global financial crisis and as unemployment creeps higher.

With the unemployment rate edging up to 5.7 per cent in June, its highest level since September 2009, the consumer attitude towards increased savings which was established following the GFC looks set to continue. Household savings as a proportion of disposable income have been maintained at above 10 per cent for the past five quarters, lifting to 10.6 per cent during Q1 2013, according to the Australian Bureau of Statistics.

With the unemployment rate edging up to 5.7 per cent in June, its highest level since September 2009, the consumer attitude towards increased savings which was established following the GFC looks set to continue. Household savings as a proportion of disposable income have been maintained at above 10 per cent for the past five quarters, lifting to 10.6 per cent during Q1 2013, according to the Australian Bureau of Statistics.

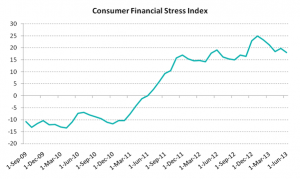

This focus on savings, combined with low interest rates, appears to be assisting Australians’ ability to meet their financial obligations, with Dun & Bradstreet’s Consumer Financial Stress Index moderating during 2013.

The index, which measures consumer demand and capacity for credit, ticked downwards in June to 18.0 points, its lowest point since November 2012. Although still at a historically elevated level, the downward trend this year is a sign that consumers’ financial prudence is translating into a more stable financial position.

Source: Dun & Bradstreet Australia

To read the full story click on the link: STRESS LEVELS EASE AS SAVINGS SWELL – Dun Bradstreet Consumer Financial Stress Index