Southeast Asia’s tech sector turns the corner

The last two years have proved challenging for the tech sector in Southeast Asia – and globally, for that matter. Escalating geopolitical tensions, soaring interest rates and growing macroeconomic headwinds prompted a “funding winter” as banks and venture capitalists adopted a much more cautious approach to lending. However, there are signs that 2024 is likely to prove a better year for the sector, writes Adrian Ashurst, CEO of Worldbox Intelligence.

The last two years have proved challenging for the tech sector in Southeast Asia – and globally, for that matter. Escalating geopolitical tensions, soaring interest rates and growing macroeconomic headwinds prompted a “funding winter” as banks and venture capitalists adopted a much more cautious approach to lending. However, there are signs that 2024 is likely to prove a better year for the sector, writes Adrian Ashurst, CEO of Worldbox Intelligence.

Heading into the black

Investors are likely to be encouraged by the news that major technology companies across the region – such as Grab, GoTo and Shopee – are inching towards or could even turn a profit in 2024 after years of heavy funding and losses as they reduce costs and improve efficiencies.

The online magazine The Diplomat says the move towards profitability reflects the fact that many of the region’s biggest unicorns have gone public over the last few years. Before that, it states, they were funded mainly by large injections of venture capital from big investment funds with billions of dollars under management. That meant the early focus for Grab, Go-Jek, Tokopedia and Shopee was to expand their market share in Southeast Asia’s booming digital economy as fast as possible, even at the cost of operating losses.

As public firms, however, they are more accountable to shareholders. Consequently, these businesses are under pressure “to pivot away from growth at all costs and toward profitability”. The Diplomat cites the example of the ride-hailing and delivery firm Grab. Its net loss fell to US$485 million in 2023, from US$1.7 billion in 2022. Grab has been cutting costs, reducing consumer and driver incentives, and experimenting with changes to its fee structure in some markets. 1

In February 2024, Bloomberg reported that Grab had posted its first-ever profit on an adjusted basis for the September quarter. While forecasting that revenue would fall below analysts’ expectations in 2024, Grab said it expected revenue to accelerate from 2025 as new initiatives it is developing take hold, in areas from digital finance to core delivery services. 2

Funding winter forces companies to adopt a more pragmatic approach

Confirmation that the region’s tech companies can indeed deliver profits to investors should boost the flow of funds into the sector. There is little doubt, however, that raising funds will remain challenging in 2024. This lack of capital should ensure companies adopt more realistic business models. As Roshan Raj, a partner at the tech consultancy Redseer Strategy Consultants, told Nikkei Asia, “One positive outcome of the current phase of capital constraints is that for at least the next three to five years, newer startups will prioritize sustainable growth.” 3

Private funding fell to its lowest level in six years in 2023. There are reasons to hope that the funding winter might start to thaw this year as interest rates fall. Indeed, venture capitalists interviewed by CNBC believe that the flow of funding into the sector should start to pick up in the second half of 2024. 4 However, to attract funding, tech companies will need to show investors that they have clear and viable paths to profitability, according to the economy SEA report 2023 by Google, Temasek, and Bain & Company.

Growth areas abound

Technology has transformed many areas of Southeast Asian society over the past few years. People shop and transfer money using methods unknown just a decade ago. Yet there remains significant scope for growth. The economy SEA report 2023 expects to see continued growth in eCommerce, transport and food, online travel, online media, and financial services.

It also expects new sectors, such as climate technology (climate tech), to establish themselves in 2024. This sector is expected to attract the most financial backing from investors, reflecting concern about climate change. Eco-friendly innovations should help to reduce greenhouse-gas emissions, protect the soil, keep water clean, increase energy efficiency, and create jobs. 5

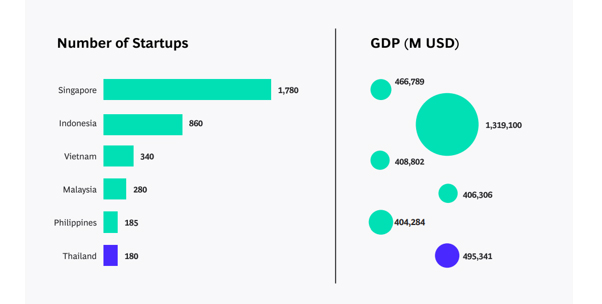

Figure 1: Tech startups in Southeast Asia, as at December 2023

Singapore leads but the race is heating up

Singapore will continue to lead the region’s tech charge. Its position as the leading financial centre in the Asia-Pacific region and the third globally, after London and New York, gives the city state a significant advantage in attracting venture-capital funds as well as foreign and home-grown entrepreneurs. However, it faces growing competition. Indonesia now has the second-largest number of tech unicorns – a startup that surpasses a valuation of US$1 billion – in Southeast Asia, after Singapore.

Indonesia’s large domestic market, growing middle class and digital-savvy young population is helping to drive the growth of startups and unicorns. Countless startups are being launched every day despite tough economic conditions that have led many to shut up shop over the past two years. Industry insiders certainly remain optimistic. Roshan Raj told Nikkei Asia, for example: “The macroeconomic prospects for Indonesia and Southeast Asia continue to outshine many other regions. Improved capital market sentiment is likely to boost private investments.” 6

The tech scene is also exploding in Vietnam, helped by a huge output of IT graduates: more than 57,000 enter the job market annually, and more than 400 universities offer courses in areas related to science and technology, including artificial intelligence, the cloud, and big data. Vietnam is forecast to see the region’s biggest increase both in the size of the internet economy by 2025 and in venture-capital deals from 2025 to 2030, according to the economy SEA report 2023.

Thailand and Malaysia poised for growth

But don’t discount the likes of Thailand and Malaysia. Thailand has a thriving startup ecosystem and the Boston Consulting Group (BCG) believes the number of tech startups is likely to take off in the kingdom in the coming years, particularly in sectors like Industry 4.0, software, fintech, B2B marketplaces, and climate tech. 7 Thailand’s advantages include a strong digital and connectivity infrastructure. In addition, the Thai government, in line with its Industry 4.0 vision, has introduced platforms such as digital ID, electronic payment, and open data – all designed to facilitate participation and innovation in the digital economy, says BCG.

Malaysia, which was once known as “the Silicon Valley of the East”, is striving to recapture its former glory. It has recently re-emerged as a major destination for chip investment as companies such as Intel and Infineon Technologies try to diversify production. Developing a more advanced chip industry with a more skilled workforce is critical for Malaysia, says Nikkei Asia, as other Asian countries with cheaper labour, like Vietnam, Thailand and India, are also competing to build up semiconductor sectors.

Overall, the tech sector in Southeast Asia should continue to see strong growth in the coming years. These countries have an abundance of young and talented tech graduates, and the need for new ways of delivering goods and services is certainly there, in sectors from retailing to financial services. As interest rates fall this year, it should also become easier to gain funding to back new ideas.

Sources:

1 – https://thediplomat.com/2024/04/southeast-asian-tech-giants-poised-for-profitability-in-2024/

5 – https://economysea.withgoogle.com/report/

Source: WORLDBOX PRESS RELEASE APRIL 2024

About Worldbox Business Intelligence

Worldbox Business Intelligence, headquartered in Switzerland, is a Global API data solution provider of business intelligence and used in data analytics.

With the Global API solution Worldbox Business Intelligence enables clients and partners also a frictionless real time onboarding, KYC and compliance verification while rapid global investigations are provided, if needed.

Worldbox Business Intelligence provides global data in a standardised structure to more than 200 Million companies worldwide. The global network of subsidiaries, branches and desks allows to precisely and efficiently collect data and target key territories for clients and partners.”

“Worldbox Business Intelligence – Bringing Swiss Precision To Data”

Copyright (C) 2024 Worldbox Business Intelligence. All rights reserved.

Our mailing address is:

Worldbox Business Intelligence

Breitackerstrasse 1

Zollikon

Zurich 8702

Switzerland