CoreLogic second quarter revenues totaled $386.0 million, up 5.5% (7.2% on a constant-currency basis) from prior-year levels, as higher U.S. mortgage origination volumes, market share gains in core underwriting solutions and demand for property data and analytics drove improved results.

Operating income from continuing operations up 48.0% to$60.7 million reflecting the benefits of revenue growth, favorable business mix and cost management. Net income from continuing operations was up 23.4% to $33.0 million. Diluted EPS increased 24.1% to $0.36. Adjusted EPS rose 41.0% to $0.55. Adjusted EBITDA was up 21.1% to $117.8 million; adjusted EBITDA margin was up 390 basis points to 30.5%.

Second-Quarter Financial Highlights

Second-Quarter Financial Highlights

Second quarter revenues totaled $386.0 million, up 5.5% (7.2% on a constant-currency basis) from prior-year levels, as higher U.S. mortgage origination volumes, market share gains in core underwriting solutions and demand for property data and analytics drove improved results.

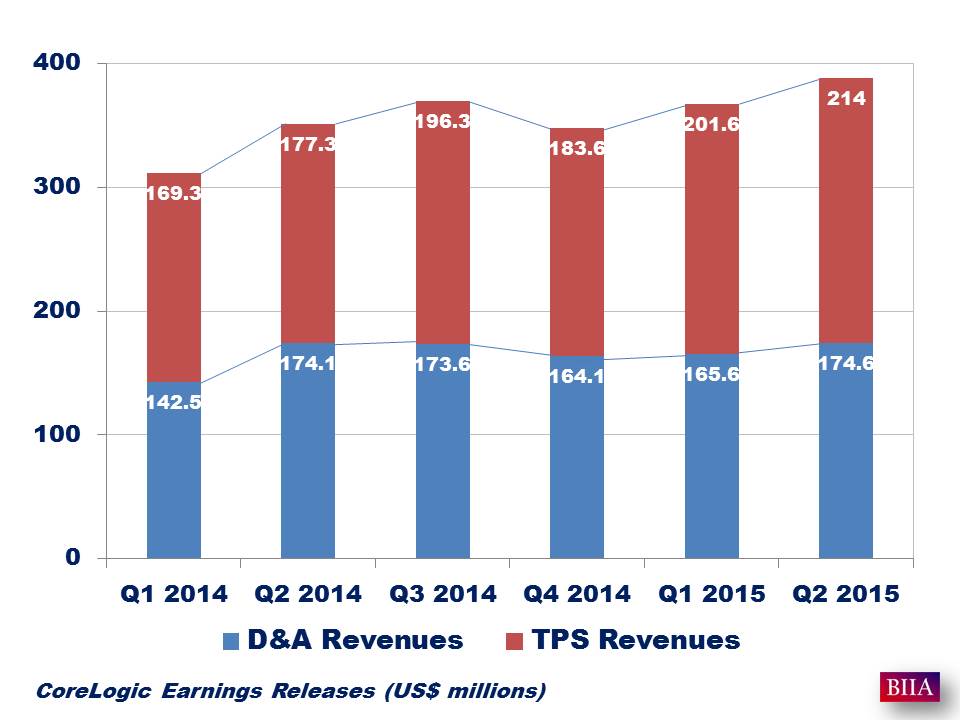

TPS revenues increased 8.0% year-over-year to $214.0 million driven primarily by higher demand for mortgage-related underwriting solutions and market share growth in our payment processing, flood services and credit services units.

D&A revenues were $174.6 million, up 2.2% (5.8% on a constant-currency basis) compared with the prior year. Higher D&A revenues were driven principally by growth in insurance, spatial solutions, international and property data revenues, which more than offset the impact of unfavorable foreign currency translation.

“CoreLogic delivered another strong operating performance in the second quarter. We grew revenues and gained market share in a number of our core operations. We also continued to invest in our NextGen technology platform and in our product and service development,” said Anand Nallathambi, President and Chief Executive Officer of CoreLogic. “As we move forward, we are squarely focused on enabling and accelerating the growth of our unique underwriting, compliance and risk management-related solutions which are powered by our industry-leading property data, analytics and data-enabled workflow tools and platforms.”

Source: CoreLogic Earnings Release