Dun & Bradstreet Holdings, Inc. (NYSE: DNB), a leading global provider of business decisioning data and analytics, today announced unaudited financial results for the fourth quarter and year ended December 31, 2022. A reconciliation of U.S. generally accepted accounting principles (“GAAP”) to non-GAAP financial measures has been provided in this press release, including the accompanying tables. An explanation of these measures is also included below under the heading “Use of Non-GAAP Financial Measures.”

- GAAP Revenue and Adjusted Revenue for the fourth quarter of 2022 were both $595.0 million. GAAP Revenue and Adjusted Revenue decreased 0.6% and increased 2.8% on a constant currency basis compared to the fourth quarter of 2021.

- Excluding the impact of acquisitions and divestitures, organic revenue was $614.2 million, an increase of 2.2% on a constant currency basis compared to the fourth quarter of 2021.

- GAAP net income for the fourth quarter of 2022 was $22.8 million, or $0.05 diluted earnings per share, compared to net loss of $11.6 million or diluted loss per share of $0.03 for the prior year quarter. Adjusted net income was $139.2 million or adjusted diluted earnings per share was $0.32, compared to adjusted net income of $141.9 million or adjusted diluted earnings per share of $0.33 for the prior year quarter.

- Adjusted EBITDA for the fourth quarter of 2022 was $250.4 million, an increase of 3.2% compared to the fourth quarter of 2021, and adjusted EBITDA margin for the fourth quarter of 2022 was 42.1%.

“2022 was another year of solid progress for us financially, operationally and as an organization as a whole. Organic revenues on a constant currency basis accelerated to 3.5 percent growth over the prior year and we delivered just under forty percent EBITDA margins in what was an increasingly challenging macro environment,” said Anthony Jabbour, Dun & Bradstreet Chief Executive Officer. “Our business continues to transform and progress toward the achievement of our multi-year strategy. We believe that our unique mix of high-quality revenues, blue chip client base, increasing innovation, strong profitability and disciplined capital allocation differentiate us through our ability to continue delivering in modulating economic conditions.”

“2022 was another year of solid progress for us financially, operationally and as an organization as a whole. Organic revenues on a constant currency basis accelerated to 3.5 percent growth over the prior year and we delivered just under forty percent EBITDA margins in what was an increasingly challenging macro environment,” said Anthony Jabbour, Dun & Bradstreet Chief Executive Officer. “Our business continues to transform and progress toward the achievement of our multi-year strategy. We believe that our unique mix of high-quality revenues, blue chip client base, increasing innovation, strong profitability and disciplined capital allocation differentiate us through our ability to continue delivering in modulating economic conditions.”

- GAAP Revenue and Adjusted Revenue for the year ended December 31, 2022 were both $2,224.6 million. GAAP Revenue increased 2.7% and 5.8% on a constant currency basis compared to the year ended December 31, 2021. Adjusted Revenue increased 2.5% and 5.6% on a constant currency basis compared to the year ended December 31, 2021.

- Excluding the impact of acquisitions and divestitures, organic revenue was $2,242.6 million, an increase of 3.5% on a constant currency basis compared to the year ended December 31, 2021.

- GAAP net loss for the year ended December 31, 2022 was $2.3 million, or diluted loss per share of $0.01, compared to net loss of $71.7 million or diluted loss per share of $0.17 for the prior year. Adjusted net income was $472.4 million, or adjusted diluted earnings per share of $1.10, compared to adjusted net income of $471.1 million, or adjusted diluted earnings per share of $1.10 for the prior year.

- Adjusted EBITDA for the year ended December 31, 2022 was $863.5 million, an increase of 1.9% compared to the year ended December 31, 2021, and adjusted EBITDA margin for the year ended December 31, 2022 was 38.8%.

Segment Results

North America

For the fourth quarter of 2022, North America revenue was $434.9 million, an increase of $6.2 million or 1.4% and 1.6% on a constant currency basis compared to the fourth quarter of 2021. Excluding the impact of acquisitions which contributed revenue of $6.0 million and the negative impact of foreign exchange of $0.8 million, North America organic revenue increased 0.2%.

- Finance and Risk revenue for the fourth quarter of 2022 was $231.1 million, an increase of $0.6 million or 0.3% and 0.5% on a constant currency basis compared to the fourth quarter of 2021.

- Sales and Marketing revenue for the fourth quarter of 2022 was $203.8 million, an increase of $5.6 million or 2.8% and 2.9% on a constant currency basis compared to the fourth quarter of 2021.

North America adjusted EBITDA for the fourth quarter of 2022 was $214.9 million, an increase of 1.7%, with adjusted EBITDA margin of 49.4%.

For the year ended December 31, 2022, North America revenue was $1,587.1 million, an increase of $87.7 million or 5.8% and 6.0% on a constant currency basis compared to the year ended December 31, 2021. Excluding the impact of acquisitions which contributed revenue of $49.4 million and the negative impact of foreign exchange of $1.6 million, North America organic revenue increased 2.7%.

- Finance and Risk revenue for the year ended December 31, 2022 was $866.9 million, an increase of $32.2 million or 3.9% and 4.0% on a constant currency basis compared to the year ended December 31, 2021.

- Sales and Marketing revenue for the year ended December 31, 2022 was $720.2 million, an increase of $55.5 million or 8.3% and 8.4% on a constant currency basis compared to the year ended December 31, 2021.

North America adjusted EBITDA for the year ended December 31, 2022 was $718.0 million, an increase of 0.4%, with adjusted EBITDA margin of 45.2%.

International

International revenue for the fourth quarter of 2022 was $160.1 million, a decrease of $9.5 million or 5.6% and an increase of 5.9% on a constant currency basis compared to the fourth quarter of 2021. Excluding the negative impact of foreign exchange of $19.7 million and the impact of divestitures, organic revenue on a constant currency basis increased 7.0%.

- Finance and Risk revenue for the fourth quarter of 2022 was $106.0 million, a decrease of $4.2 million or 3.8% and an increase of 6.7% on a constant currency basis compared to the fourth quarter of 2021.

- Sales and Marketing revenue for the fourth quarter of 2022 was $54.1 million, a decrease of $5.3 million or 8.9% and an increase of 4.4% on a constant currency basis compared to the fourth quarter of 2021.

International adjusted EBITDA for the fourth quarter of 2022 was $49.0 million, an increase of 6.6%, with adjusted EBITDA margin of 30.6%.

International revenue for the year ended December 31, 2022 was $637.5 million, a decrease of $33.5 million or 5.0% and an increase of 4.6% on a constant currency basis compared to the year ended December 31, 2021. Excluding the negative impact of foreign exchange of $64.8 million and the impact of divestitures, organic revenue on a constant currency basis increased 5.4%.

- Finance and Risk revenue for the year ended December 31, 2022 was $419.1 million, a decrease of $11.2 million or 2.6% and an increase of 6.2% on a constant currency basis compared to the year ended December 31, 2021.

- Sales and Marketing revenue for the year ended December 31, 2022 was $218.4 million, a decrease of $22.3 million or 9.2% and an increase of 1.9% on a constant currency basis compared to the year ended December 31, 2021.

International adjusted EBITDA for the year ended December 31, 2022 was $202.2 million, an increase of 4.2%, with adjusted EBITDA margin of 31.7%.

Business Outlook

- Revenues after the impact of foreign exchange are expected to be in the range of $2,260 million to $2,300 million, or ∼1.6% to 3.4%.

- Organic revenue growth is expected to be in the range of 3.0% to 4.5%.

- Adjusted EBITDA is expected to be in the range of $870 million to $920 million.

- Adjusted EPS is expected to be in the range of $0.92 to $1.00. (1)

(1) For 2023, Adjusted diluted earnings per share now excludes the impact of non-operational/non-cash pension income. For comparative purposes, starting with 2023, we have revised the prior year Adjusted diluted earnings per share to exclude the impact of non-operational/non-cash pe nsion income. See page 16 for the revised 2020-2022 results.

nsion income. See page 16 for the revised 2020-2022 results.

Source: Dun & Bradstreet Earnings Release

How did the stock market react following the earnings release?

How did the stock market react following the earnings release?

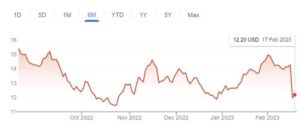

Shares of Dun & Bradstreet (NYSE:DNB) fell 13.9% to $12.29 in afternoon trading (February 16, 2023), after the provider of decisioning data and analytics reported mixed Q4 results and provided underwhelming guidance for 2023 (as one commentator phrased it).