First-quarter Revenue Rises on Robust Credit Demand in North America

Experian reported higher first-quarter total revenue on Thursday, as the world’s largest credit data firm benefited from a robust demand in demand and supply of credit, mainly in North America.

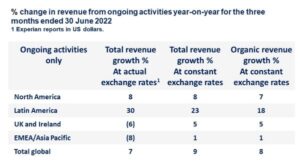

While overall demand for credit reports and scores is rising as the global economy emerges from the pandemic, the company now has to battle a fall in consumer spending across Experian’s main markets — North America and the UK. The company, which lets 122 million people their credit scores and eligibility, posted a 7% increase in organic revenue from North America for the quarter ended June 30, while flagging a fall in demand for mortgage credit. Experian also saw robust demand in its consumer services unit, and reiterated its full-year organic revenue outlook of 7-9% rise for the whole  group.

group.

Brian Cassin, Chief Executive Officer, commented:

“We grew strongly in Q1, in line with our expectations, underpinned by our portfolio diversity and growth initiatives. Total revenue growth was 7% at actual exchange rates and 9% at constant exchange rates. Organic revenue growth was 8%.

“Our expectations for the full year are unchanged. We expect organic revenue growth in the range of 7-9%, total revenue growth in the range of 8-10% and modest margin accretion, all at constant exchange rates.”

North America – 65% of Group revenue4

North America delivered organic revenue growth of 7%, with ongoing strength in bureau volumes (excluding mortgage), good demand for analytics and software, expansion in the key verticals of health, targeting, automotive and verification services, and continued momentum in Consumer Services. Respectively, growth was 5% and 13% across B2B and Consumer Services. Total revenue growth was 8% including acquisition contributions from verification services and from insurance marketplaces.

In B2B, our clients continue to invest in developing their digital platforms, helping to drive growth across all major business units. In financial services most clients continue to focus on new credit issuance and investment in their digital infrastructure. Bureau volumes were strong, excepting mortgage. Our analytical and decisioning suite performed well, with good demand for analytics, and growth in decisioning software and across fraud and identity management. Our major verticals also performed robustly.

Consumer Services has started the year strongly, delivering growth of 13%. Our credit marketplace performed very well, reflecting our ability to deliver large audiences to our lending partners as our free membership base reached 55m. There was particularly good growth in cards and loans, with strength in both demand and supply of credit. As expected, paid membership was stable.

Latin America – 13% of Group revenue4

Latin America maintained its strong trajectory delivering organic revenue growth of 18%. At constant currency, total revenue growth was 23%, including contributions from acquisitions in fraud and identity management, and in Consumer Services, and from our new bureau in Chile.

B2B organic revenue growth was 15%. In Brazil, bureau volume growth was strong, driven by client adoption of our positive data scores, features and attributes. The number of installations of Experian Ascend also increased and we continue to see good take-up of our cloud-enabled decisioning platforms. We also saw growing contributions from fraud and identity management, our small and medium enterprise channel and our new agribusiness vertical.

Consumer Services delivered organic revenue growth of 42%. Free consumer memberships in Brazil rose to 73m, whilst our credit collection marketplace Limpa Nome, and our credit comparison marketplace both performed strongly.

UK and Ireland – 14% of Group revenue4

Organic and total constant currency revenue growth in the UK and Ireland was 5%.

While the macroeconomic outlook in the UK has softened, our UK and Ireland B2B operations have been resilient delivering organic growth of 6%. This reflects strong new business traction and particularly good progress across our consumer credit, business credit and fraud and identity management activities. Our clients continue to invest in new credit origination and bureau volumes have been good. We continue to progress our innovation strategy, including rapid progress in building a new capability in income and employment verification.

Organic revenue in Consumer Services was flat, with strong growth in transaction volumes across our credit comparison marketplace, offset by moderation in our premium subscription services as we lapped a strong prior year comparable. Free memberships were 11m.

EMEA/Asia Pacific – 8% of Group revenue4

Organic revenue growth and total revenue growth at constant exchange rates across EMEA/Asia Pacific was 1%. Overall performance was affected by weak macroeconomic conditions in some markets. We continue to execute on our strategy to concentrate on strategic markets where we can drive scale while also enhancing operating efficiency.

4 Percentage of Group revenue from ongoing activities calculated based on FY22 revenue at actual exchange rates.

5 Ongoing activities only, at constant exchange rates.

CI = Consumer Information, BI = Business Information, DA = Decision Analytics.

This announcement is available on the Experian website at www.experianplc.com.

Source: Experian