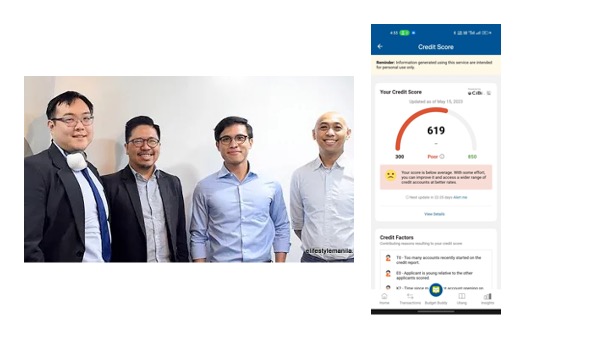

To help more Filipinos gain access to their credit scores, Lista, the fastest-growing financial management app in the Philippines, has entered into an agreement with the country’s leading credit bureau, CIBI Information Inc. (CIBI). The Credit Information Corporation (CIC), the country’s sole public credit registry and repository of credit information, authorizes Lista to access CIC credit data through CIBI as a Non-accessing Entity (NAE).

By being authorized as an NAE, Lista further solidifies its standing as a trusted and reliable platform for credit information, bolstering its credibility within the industry. With this authorization, Filipinos can confidently rely on Lista to access comprehensive and up-to-date credit scores, empowering them to make informed financial decisions.

Additionally, through this strategic partnership with CIBI, Lista users can conveniently obtain their credit scores and gain access to a range of credit services, paving the way for enhanced financial opportunities. All of these benefits are available to users at an attractive introductory price of only P199.

Credit scores play a crucial role in assessing an individual’s creditworthiness and the likelihood of repaying loans and credit card debts. According to a recent financial inclusion survey conducted by the Bango Sentral ng Pilipinas (BSP), it was discovered that a significant proportion of adults, approximately 70 percent, lack access to vital financial services, including savings  accounts, and credit facilities. The study also revealed that an alarming 57 percent of Filipinos rely on informal sources for borrowing, with 44 percent resorting to seeking financial assistance from their own family and friends.

accounts, and credit facilities. The study also revealed that an alarming 57 percent of Filipinos rely on informal sources for borrowing, with 44 percent resorting to seeking financial assistance from their own family and friends.

Source: MalayaBusinessInsights