S&P/Experian Consumer Credit Default Indices Show Composite Default Rate Drop to Five-Month Low in May 2017 – Bank Card Default Rate Rises Seven Straight Months

S&P/Experian Consumer Credit Default Indices Show Composite Default Rate Drop to Five-Month Low in May 2017 – Bank Card Default Rate Rises Seven Straight Months

S&P Dow Jones Indices and Experian released data through May 2017 for the S&P/Experian Consumer Credit Default Indices. The indices represent a comprehensive measure of changes in consumer credit defaults and show that the composite rate dropped four basis points from last month to 0.86%. In addition, the bank card default rate increased 18 basis points from April to 3.53%, auto loan defaults decreased five basis points from the previous month to 0.85%, and the first mortgage default rate dropped five basis points from April to 0.64%.

Four of the five major cities saw their default rates decrease in the month of May. New York experienced the largest decrease, down nine basis points from April to 1.01%. Los Angeles reported 0.66% for May, dropping three basis points from the previous month. Dallas came in at 0.67%, down two basis points from April. Miami was down one basis point from April to 1.29%. At 0.97%, Chicago was the only city reporting a default rate increase of three basis points from the previous month.

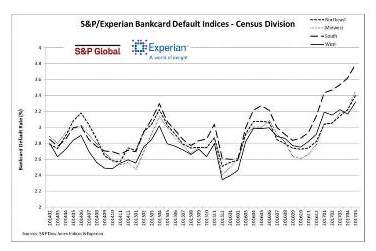

The National bank card default rate of 3.53% in May set a 48-month high. When comparing the bank card default rate among the four census divisions, the default rate in the South is considerably higher than the other three census divisions. The East South Central Census Region – comprised of Kentucky, Tennessee, Alabama, and Mississippi – has the highest bank card default rate. As per the Bureau of Labor Statistics, these states have some of the lowest median household income.

About The S&P/Experian Consumer Credit Default Indices

Jointly developed by S&P Dow Jones Indices LLC and Experian, the S&P/Experian Consumer Credit Default Indices are published on the third Tuesday of each month at 9:00 am ET. They are constructed to track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien. The Indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month. Experian’s base of data contributors includes leading banks and mortgage companies, and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.

For more information, please visit: www.consumercreditindices.standardandpoors.com.

For more information, please visit: www.consumercreditindices.standardandpoors.com.

Source: Experian Press Release