The Thomson Reuters 2023 Corporate Global Trade Survey Report explores the challenges and trends facing global trade professionals in an environment of constant disruption and uncertainty. Topics include inflation, supply-chain shortages, international conflicts, trade compliance, technology adoption, ESG reporting, and the growing skill gap. Data was sourced from surveys of 177 global trade professionals from various regions, sectors, and revenue levels.

Survey results show that global trade professionals are dealing with familiar sources of disruption, such as tariffs, sanctions, regulatory changes, and transportation troubles, but also with new or intensified factors, such as climate change, post-pandemic inflation, and data-intensive demands. Key findings from the report include:

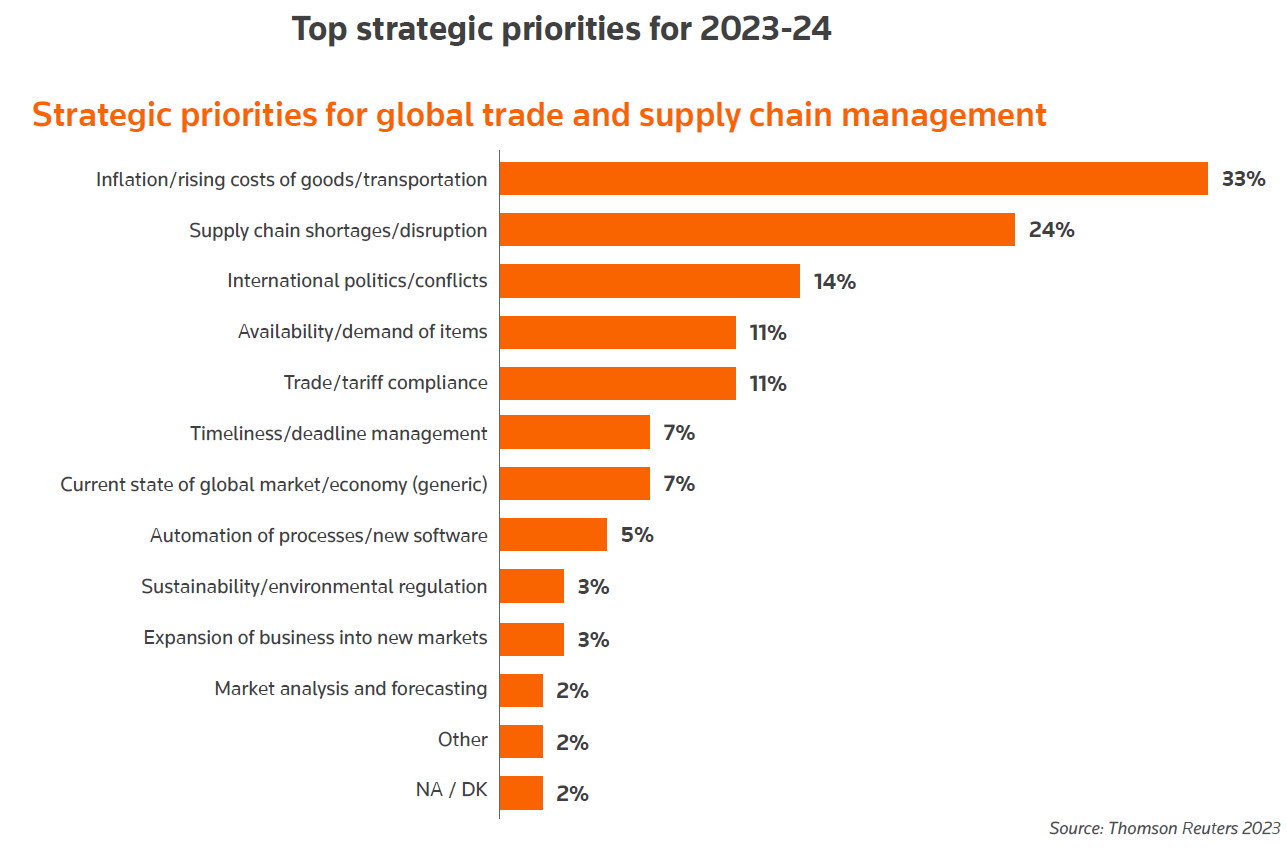

- One-third of companies report that inflation and the rising cost of goods and transportation are the top strategic priority for the next 12 months

- More than two-thirds of businesses take ESG considerations into account in their decision to use a supplier, and 88% collect ESG data from their suppliers at least once a year

- 65% of companies with more than $100 million in revenue are implementing technology upgrades, and 62% rate supply-chain security and data protection as their top technology priority

- 57% of companies outsource some aspects of global trade or supply-chain management

- One-third of businesses report suffering from understaffing and lack of budget

Insights from this report can be leveraged to guide a future-proofing process for organizations by detailing how global trade leaders are adapting to the changing landscape and what their strategic priorities are for the next 12 months.

Please CLICK HERE to download the white paper.

Source: SupplyChainBrain