Verisk Analytics total revenue increased 10.0% in third-quarter 2013 compared with third-quarter 2012. Excluding the impact of recent acquisitions, revenue grew 6.1% for third-quarter 2013. Revenue growth in the third quarter was driven by an 11.2% increase in Decision Analytics revenue, with additional contribution from the 7.8% growth in Risk Assessment revenue. EBITDA increased 10.9% to $202.9 million for third-quarter 2013, with an EBITDA margin of 46.3%. Net income was $96.4 million for third-quarter 2013 and adjusted net income was $106.0 million, an increase of 16.3% and 15.0%, respectively, versus the comparable period in 2012.

Scott Stephenson, president and chief executive officer, said, “We were pleased to achieve several innovation milestones in the third quarter including initial customer use of our anti-fraud, pooled data platform in the healthcare space, our first provision of Roof Insight reports using aerial imagery, and the first sale of our new supply chain platform. We remain focused on our twin goals of organic growth through innovation and efficiently scalable operations. We fully expect our innovation agenda to enable us to deliver strong growth over the long-term.

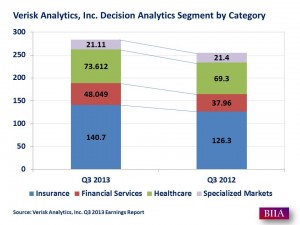

Within the Decision Analytics segment, revenue grew 11.2% for third-quarter 2013, and growth excluding recent acquisitions was 5.2%. Growth in the quarter was driven by acceleration from the insurance revenue category. Healthcare growth, while slower than in recent quarters, contributed to third-quarter growth, as did the revenue from the acquisition of Argus, which is reported in the financial services category.

Within the insurance category, revenue growth was 11.5% for the third-quarter of 2013, all organic. The increase was driven by strong growth in underwriting and catastrophe modeling solutions. Insurance fraud claims and loss quantification solutions also added to revenue growth. Overall growth was driven by the increased adoption of existing and new solutions and annual invoice increases for certain solutions.

In the financial services category, revenue increased 26.6% in third-quarter 2013 but declined 16.6% after adjusting for the acquisition of Argus. The decline in mortgage revenue within the financial services category reflected continued lower volumes in forensic audit solutions and modest declines in underwriting and appraisal solutions. Beginning in fourth-quarter 2013, Argus will be included in organic revenue growth.

In the healthcare category, revenue in the third quarter grew 6.2%. Revenue growth reflected continued expansion of solutions sold to existing customers as well as the addition of new customers, partially offset by the near-term impact of lower volumes from certain customers.

In the specialized markets category, revenue declined 1.4% in third-quarter 2013. The performance of weather and climate analytics and environmental health and safety solutions was affected by lower customer activity.

About: Verisk Analytics (VRSK) is a leading provider of information about risk to professionals in insurance, healthcare, financial services, government, and risk management. Using advanced technologies to collect and analyze billions of records, Verisk Analytics draws on vast industry expertise and unique proprietary data sets to provide predictive analytics and decision support solutions in fraud prevention, actuarial science, insurance coverages, fire protection, catastrophe and weather risk, data management, and many other fields.