Worldbox Country Risk Climate February 2024

CAMBODIA

Summary

| Overall Risk Score 19 (Stable)

Political risk: Stable 6/10 Economic risk: Stable 7/10 Commercial risk: Stable 6/10 The risk assessment of a country is made up of 3 components, being Political, Economic and Commercial. Each component is scored out of 10 with 1 being the highest risk and 10 the lowest. |

ESG Risk: 4/10 (Stable)*

*Environmental, social and governance (ESG) issues are becoming increasingly important to companies, investors and consumers in Southeast Asia. That is why we are now preparing a separate ESG score and section with our quarterly country risk reports. We explain how each country rates, looking at the E, S and G individually, and outline recent developments. |

Political Risk – Stable at 6

Nominally a parliamentary democracy with a bicameral parliament and a king as head of state, Cambodia is in fact a one-party state. Hun Sen, who became prime minister in 1985 and his Cambodian People’s Party dominates the political scene. Hun Sen stepped down as prime minister in 2023 with his eldest son Hun Manet being sworn in as the new prime minister.

The transfer followed a landslide victory for Hun Sen’s ruling Cambodian People’s Party at the July election. It won 120 of 125 seats. The US, EU and other Western nations refused to send observers to the poll, saying it was neither free nor fair. In May, the main opposition party and the sole credible challenger to Hun Sen was barred from contesting the vote. The decision by the electoral authorities to ban the Candlelight Party for allegedly filing the wrong paperwork echoes developments in the run up to the 2018 election.

Worldbox Intelligence does not expect any significant shifts in policy making following the succession of Hun Manet. Even though he has relinquished the prime minister’s job, Hun Sen, 71, is expected to retain a large amount of control as his party’s president and president of the Senate. However, Cambodia’s political stability could well be challenged. Manet is untested and his promotion would certainly not be welcomed in some parts of the CPP or the country at large. His support is reportedly limited to younger urbanites.

The transition entails some risks. As the Diplomat publication pointed out In November 2023, “Manet must attempt to build his own support among the country’s elite and ensure that he keeps a lid on discontent from below at a time of growing economic uncertainty, all while trying to assert his authority and emerge from his father’s shadow.”

Balancing relations with China, the USA and other ASEAN members is likely to be one of Manet’s most pressing tasks. December 2023 reports that Chinese warships have docked at the upgraded Ream Naval Base is causing alarm in Washington and across the region. A State Department spokesperson, for example, expressed concern about Beijing’s plans to have exclusive control over parts of Cambodia’s main naval base.

Cambodia’s neighbours are also worried Beijing has gained a new outpost near the contested South China Sea. A particular concern is that China might install advanced radar equipment that would considerably extend China’s ability to survey the Gulf of Thailand and eastern Indian Ocean.

Economic Risk – Stable at 7

Cambodia experienced some of the highest economic growth in the world in the two decades prior to the pandemic. Driven by garment exports and tourism, annual growth averaged 7.7% between 1998 and 2019. The rapid growth resulted in significant gains in poverty reduction with the poverty rate in Cambodia declining to 18% in 2020 from just under 50% percent in 2007. From 2000 to 2020, life expectancy increased from 58 years to over 70.

If Cambodia is to achieve its goal of becoming an upper-middle-income economy by 2030 and a high-income economy by 2050, it needs to maintain this high growth rate. In a blog published in December 2023, the World Bank called on the government to use the currency economic slowdown to implement reforms. It said these are the need to overcome various challenges. They include declining productivity. It said further improvements to the business environment are critical for boosting the productivity and competitiveness of Cambodian firms.

The blog argued that the cost of doing business remains relatively high in Cambodia, reducing international competitiveness and inhibiting innovation and shifts into higher value activities. It called on the government to strengthen the predictability of the regulatory environment and expand small and medium-sized enterprises’ access to finance.

The World Bank added that further efforts to streamline complex and restrictive business entry requirements, together with improvements to the functioning of the insolvency framework, would help reduce costs of entry and exit. The blog also called on the government to upgrade infrastructure and to boost productivity and international competitiveness. It added that the government also needs to address shortfalls in education that are resulting in growing skills shortages and declining labor productivity growth.

In an October 2023 Article IV consultation, the IMF echoed some of these concerns. It called for structural reforms that “focus on diversifying trade partners, investing in new growth drivers, and capitalizing on climate transition opportunities”.

It added that enhancing public governance and transparency will be vital to attract more foreign direct investment and to ensure macroeconomic stability. The IMF also called on the government to improve the quality of macroeconomic data, saying this would benefit the monitoring of the economy and policy making.

Commercial Risk – Stable at 6

Cambodia rates as one of the most difficult countries in the Asia–Pacific region in which to do business. It ranked 144 among 190, according to the 2021 World Bank Ease of Doing Business guide. This ranking is ahead of only Myanmar and Laos in Southeast Asia.

Foreign investors often complain that the decisions of Cambodian regulatory agencies are inconsistent, irrational or corrupt. Infringement of intellectual property rights is widespread, with Cambodia reportedly becoming an increasingly popular source of pirated material due to weak enforcement.

Cambodia ranks joint 150th out of 180 countries – and joint equal with Afghanistan – in Transparency International’s (TI) 2022 Corruption Perceptions Index, albeit moving up 10 places over the course of the year. The country’s score has been steadily rising since 2019. However, it continues to be the second lowest-rated country in ASEAN ahead of only Myanmar and one of the lowest in Asia.

February Bulletin

Political Risk – Stable at 6

Cambodia faces perhaps its most testing political outlook in many years following the transfer of power from Hun Sen to his eldest son Hun Manet. However, Hun Sen will continue to exert considerable, if not decisive, influence. Moreover, Hun Sen has carefully managed any potential opposition to Manet within the CPP, according to the Asia Times.

It argues that by “allowing powerful party members such as Minister of National Defense Tea Banh and Minister of Interior Sar Kheng to pass their own positions to their children, the Hun family has maintained stability by dividing the country’s spoils among the next generation of CPP elites”.

Hun Manet is unlikely to face any serious opposition from outside Cambodia. The Japan Times has pointed out that “barely weeks after the EU and U.S. had condemned his father’s government for stealing the vote — with Japan adopting the milder stance of closely watching the situation “with concern” — Hun Manet was being offered the trappings of international legitimacy.”

The newspaper cites a meeting Manet held with Japanese Prime Minister Fumio Kishida in September. It adds that subsequently Hun Manet addressed the U.N. General Assembly in New York, claiming the legitimacy of the July election, and later attended a private dinner with major U.S. companies including Pfizer and others who already have investments in Cambodia, such as Coca-Cola and General Electric.

The question remains as to what sort of leader Hun Manet will become. Some analysts have suggested that he could be a reformer. However, that verdict seems highly premature. In addition, as the Cambodian expert Professor Sophal Ear has pointed out Hun Sen could well step back into power if he were unhappy with what Hun Manet was doing.

Economic Risk – Stable at 7

The IMF, in an Article IV assessment published in October 2023, forecasts that Cambodia will be ASEAN’s fastest growing economy for two consecutive years. It is forecasting growth of 6.1% in 2024, up from an estimated 5.3% in 2022.

The continuing recovery in tourism and surging exports of solar panels and electrical components are the main growth drivers, according to the IMF. Garment exports remain weak, showing only modest signs of recovery in recent months, and slower construction activity is also weighing on growth.

The IMF also warned that “uncertainty around the outlook is high and risks are to the downside, notably weaker-than-projected demand from advanced economies and China, tighter US monetary policy, geoeconomic fragmentation, and high levels of domestic private debt.”

The government is more optimistic than the IMF forecasting growth of 6.6% in 2024, driven by the tourism, garment, agriculture, and industrial sectors. It projects inflation at 2.5% in 2024, the same rate as that of 2023, provided there is no spike in oil prices.

Membership of the Regional Comprehensive Economic Partnership (RCEP) is proving a boon for Cambodia. The RCEP is an institutional arrangement for regional economic integration in the Asia-Pacific region, which came into effect at the beginning of 2022. It was signed by the 10 member countries of the Association of Southeast Asian Nations and Australia, China, Japan, New Zealand and South Korea. Cambodia exported $7.21 billion worth of products to RCEP member countries in the first 11 months of 2023, up 27% from the corresponding period last year.

The main risks to the economy include the slowdown in China, a key export market and source of FDI. The World Food Programme has warned that El Nino climate pattern could have an adverse effect on the Kingdom’s agricultural output, quite possibly leading to an increase in the price of food items. Rising oil price are another major inflationary risk factor given the country imports oil for most of its requirements.

Commercial Risk – Stable at 6

In its October 2023 Article IV assessment, the IMF said that the banking sector is well capitalized and profitable according to financial soundness indicators, but the recent deterioration in asset quality and the high level of private sector debt require close monitoring.

The IMF also expressed concern about the growth of private debt. It said the private credit-GDP ratio remains elevated for Cambodia’s level of development at around 160%. The IMF added that non-performing loans rose to 4.6% of total loans in August reflecting a roll-back in forbearance measures and potentially rising stresses in parts of the economy.

However, in August 2023, a report by Yuanta Securities indicated that concerns over levels of private debt could prove unfounded. It pointed out that the private sector’s debt level relative to GDP, particularly for countries like Cambodia, tends to be overestimated due to the country’s substantially larger informal economy and significantly smaller government final consumption expenditure.

Counterparty risk, already difficult to assess, given the availability and reliability of data.

Environmental, Social and Governance (ESG) – Stable at 4

The United Nations’ Sustainable Development Goals (SDGs) are recognized as a beneficial framework for responsible investment. The Sustainable Development Report from Cambridge University Press assesses the progress of all 193 UN Member States on the SDGs. It provides a useful means of ranking Southeast Asian countries on their ESG progress.

Cambodia is ranked 103 out of 166 in the 2022 report with a score of 64.8.

Environment: Cambodia has one of the highest rates of deforestation in the world, reflecting exploitation of the country’s rainforests for timber and the clearing of land for agriculture. Meanwhile, pollution from pesticides and fertilizers is affecting the country’s coastal waters. Mangrove forests that provide important spawning grounds for fish and protection from floods, are also being cleared for activities such as shrimp farming.

Social: The US State Department lists a long litany of human rights abuses routinely engaged in by the government including:

“unlawful or arbitrary killings; torture and cruel, inhuman, or degrading treatment or punishment by the government; arbitrary detention by the government; political prisoners and detainees; serious problems with the independence of the judiciary; arbitrary interference in the private lives of citizens, including pervasive electronic media surveillance; serious restrictions on freedom of expression and media, including violence and threats of violence, unjustified arrests or prosecutions of journalists, criminal libel laws, and censorship.”

Workers’ rights are enshrined in law but in practice few of these laws are obeyed or enforced. To meet quotas, workers are often either forced to work overtime, “enticed to do so with a small bonus that is usually never paid”, according to the Borgen Report. In addition, many companies employ children under 15 even though the law states that employees should be aged 15 plus.

Governance: ESG principles have only recently appeared on the corporate agenda in Cambodia. According to the GRI Sustainability Disclosure Database, however, the total number of sustainability reports in Cambodia has more than doubled since 2015, with the majority of these reports coming from the financial services sector.

February Bulletin

Environmental, Social and Governance (ESG) – Stable at 4

A senior Cambodian government official has urged the private sector, especially in the textile, garment, footwear and travel products sector, to observe the ESG principles, arguing they will be a key requirement by big buyers in the future.

According to a report in the Phnom Penh Post, Chea Vuthy, deputy secretary-general of the Cambodian Investment Board and Cambodian Special Economic Zone Board under the Council for the Development of Cambodia (CDC), said the country’s key economic sectors – agriculture, garment manufacturing, textile, footwear and travel products – would be at risk if industry players fail to comply with ESG.

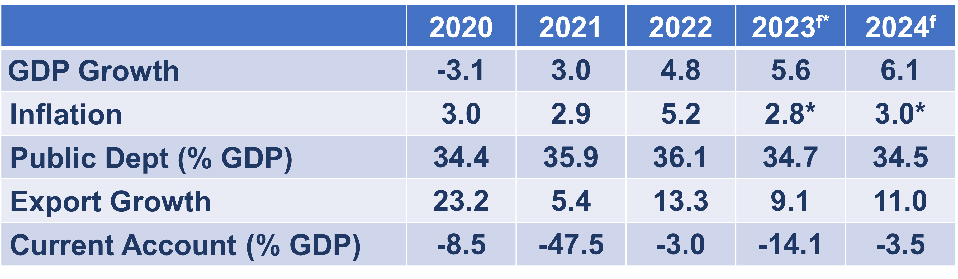

Latest economic data

f – forecasts

* AMRO

Source: IMF/ WorldBank/Asian Development Bank, except where stated.

Useful Links

https://www.transparency.org/en/cpi/2021

https://www.imf.org/en/Countries/KHM

https://www.adb.org/countries/cambodia/main

https://dashboards.sdgindex.org/profiles/cambodia

About Worldbox Business Intelligence

Worldbox Business Intelligence, headquartered in Switzerland, is a Global API data solution provider of business intelligence and used in data analytics.

With the Global API solution Worldbox Business Intelligence enables clients and partners also a frictionless real time onboarding, KYC and compliance verification while rapid global investigations are provided, if needed.

Worldbox Business Intelligence provides global data in a standardised structure to more than 200 Million companies worldwide. The global network of subsidiaries, branches and desks allows to precisely and efficiently collect data and target key territories for clients and partners.”

“Worldbox Business Intelligence – Bringing Swiss Precision To Data”

Copyright (C) 2024 Worldbox Business Intelligence. All rights reserved.

Our mailing address is:

Worldbox Business Intelligence

Breitackerstrasse 1

Zollikon

Zurich 8702

Switzerland