Worldbox Country Risk Climate February 2024

LAOS

Summary

| Overall Risk Score 16 (Stable)

Political risk: Stable 7/10 Economic risk: Stable 5/10 Commercial risk: Stable 4/10 The risk assessment of a country is made up of 3 components, being Political, Economic and Commercial. Each component is scored out of 10 with 1 being the highest risk and 10 the lowest. |

ESG Risk: 4/10 (Stable)*

*Environmental, social and governance (ESG) issues are becoming increasingly important to companies, investors and consumers in Southeast Asia. That is why we are now preparing a separate ESG score and section with our quarterly country risk reports. We explain how each country rates, looking at the E, S and G individually, and outline recent developments. |

Political Risk – Stable at 7

The Lao People’s Democratic Republic, as Laos is officially known, has been a one-party state since its foundation in 1975 at the end of the Indochina war. The only legal party is the Lao People’s Revolutionary Party (LPRP). There is no organized opposition and no truly independent civil society. A 61-member Central Committee of the LPRP, under the leadership of the 11-member Politburo, makes all major decisions. National Assembly elections are held every five years but are not free or fair, while protests are banned.

The LPRP is now facing perhaps the most challenging period since independence. It oversaw strong economic growth after liberalising the economy in the late 1980s and early 1990s. During the decade up until 2019, the economy grew by an average 7% per annum and Laotians enjoyed rising living standards and improved access to electricity and healthcare.

However, the Covid-19 pandemic exposed the country’s economic vulnerabilities. Economic growth fell sharply and inflation surged as the currency depreciated significantly. Many Laotians left the country, while millions more suffered extreme hardship. This background could prove a severe threat for many governments but in Laos there is no credible alternative to the LPRP, which is why Worldbox Intelligence believes the country will remain stable.

A pickup in the country’s economic fortunes could also release some of the pressures on Lao society. Economic growth is recovering while inflation, while remaining high, is edging down.

Economic Risk – Stable at 5

Laos remains one of the poorest countries in the world, despite achieving significant progress over the past 20 years. Levels of poverty halved while education and health outcomes improved. However, subsistence agriculture – dominated by rice – accounts for about 40% of GDP and provides 80% of total employment. Hydroelectric power and textiles account for over two-thirds of country’s exports, while coffee is another major export earner. Tourism has become the country’s single biggest earner of foreign exchange.

Accession into the World Trade Organization in 2013 and the creation of the ASEAN Economic Community (AEC) in 2015 precipitated significant reforms designed to improve the business and investment environment. Rapid economic growth in neighbouring countries such as China, Vietnam and Thailand has also boosted trade and FDI.

China, Thailand and Vietnam are the country’s main trade and investment partners. Trade with China is growing particularly rapidly, aided by massive Chinese FDI and the China–Laos Railway project, which travels across Laos from the Chinese border to the capital Vientiane. Three Chinese-backed highway projects are also underway as part of China’s Belt and Road Initiative.

The government hopes the railway project will energise growth by encouraging FDI and attracting increasing tourism from China. However, there are growing concerns about Laos foreign debt, with borrowed money used to pay for much of the railway’s construction. The country’s public and publicly-guaranteed debt stands at 123% of GDP as of 2023, according to the IMF. The risk associated with this debt, largely denominated in dollars, increases during periods when the kip is depreciating, as was the case in 2022 and 2023.

About $US10.4 billion of the debt, equal to around 55% of Laos’ GDP, is owed to China under infrastructure deals in China’s Belt And Road Initiative, or BRI. Laos has borrowed billions from Beijing to finance railways, highways and hydroelectric dams, depleting its foreign reserves in the process. The government has implemented several stability measures, including interest rate increases, bond issuances, and working with the Asian Development Bank on debt management practices. But it urgently needs a debt refinancing package with China.

In September 2023, Nikkei cited the ADB’s Laos senior country economist, Emma Allen, as saying that “public debt is now at a critical level,” adding that “debt servicing [presents] substantial risks to the outlook.”

Commercial Risk – Stable at 4

Corruption is a significant challenge. Laos ranks 126th out of 180 countries in Transparency International’s (TI) 2022 Corruption Perceptions Index, moving up eight positions from its 2021 score. Laos is considered to be the third most corrupt country in the ASEAN region, behind Myanmar and Cambodia.

The Laos Corruption Report by GAN also declares that corruption is a high risk for companies operating in Laos and deters foreign investment. GAN says that political patronage pervades all business sectors, and a culture of corruption has been perpetuated by senior LPRP leaders and by foreign investors willing to buy political support and pay off officials. It adds that companies are likely to encounter petty bribery when trading across borders, paying taxes or acquiring public services.

In terms of the rule of law, GAN says that a weak and inefficient judiciary impedes the proper enforcement of anti-corruption laws and officials are rarely prosecuted. It adds that bribery is widespread in both civil and commercial cases, and the legal system is subject to political interference.

February Bulletin

Political Risk – Stable at 7

In December, the government introduced new measures to address the nation’s severe economic problems, including imposing exchange rate controls and regulating food prices. A month earlier, it raised the minimum wage for the third time since 2018, recognition of the considerable hardships facing the majority of Laotians.

The new measures include cracking down on black market currency exchanges, boosting domestic production and encouraging the flow of foreign currencies into the nation’s commercial banking system. Civil servants, meanwhile, will be paid a new monthly allowance equivalent to around US$7.50.

At the same time the government has cracked down hard on any signs of dissent. There is no organised opposition and so there is little threat to the continued rule of the LPRP.

Economic Risk – Stable at 5

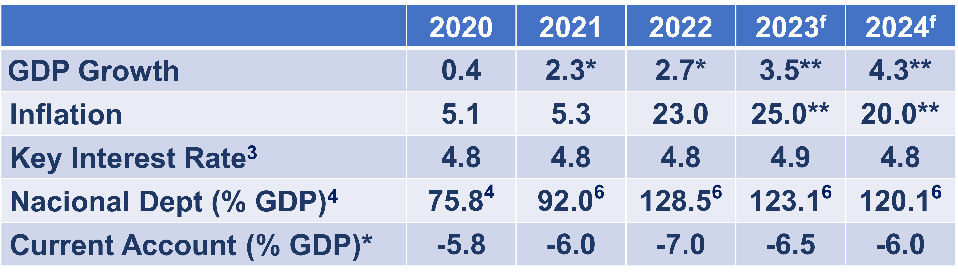

The economy continued to improve in 2023, according to the Lao Economic Monitor, published by the World Bank in November 2023. Growth of 3.7% overall is expected in 2023, up from 2.7% in 2022. An improved performance in tourism, transport and logistics services, and foreign investment has contributed to the recovery.

The Monitor adds, however, that growth is lower than previously expected, mainly because of the falling value of the kip, inflation, labour shortages, and unfavorable weather. The government took measures to improve its finances by controlling expenditure and increasing domestic revenues in the first half of 2023. It has raised excise rates on vehicles, alcohol, and tobacco.

The Monitor says that while the government earned more than it spent in the first half of 2023, debt repayments remain high and renegotiating the country’s debt burden is crucial. Meanwhile the pressure on the public finances is weighing on investment in human capital. Combined public spending on education and health declined from 4.9% of GDP in 2013 to an estimated 2.3% in 2023.

The depreciation of the kip is one of the main factors behind the surge of inflation Driven by persistent external imbalances, the kip depreciated sharply in 2022. That trend continued in 2023, the kip falling in value by 29% against the Thai baht and 21% against the US dollar in the year to October 2023. On average, says the Monitor, a 1% fall in the value of the kip increases consumer prices by 0.5%. Therefore, it concludes, inflation will remain high until exchange rates stabilize. Laos recorded an inflation rate of 25.24% in November, a slight decrease from 25.8% in October, according to the latest report from the Lao Statistics Bureau.

The government is forecasting an expansion of 4.5% in 2024. However, the economic outlook is subject to significant uncertainty, reflecting risks such as the impact of lower global and regional growth, which would lower demand for Lao exports. Any escalation in global tensions could also raise commodity prices, which would feed domestic inflation.

Domestic risks, according to the Monitor, include further loss of foreign currency because of debt service obligations, slow progress with structural reforms, and a deterioration of bank balance sheets.

Commercial Risk – Stable at 4

Counterparty risk, already difficult to assess (corporate financial information is rarely available and, when available, is usually unreliable), has almost certainly risen during the pandemic. The legal system continues to make debt collection very unpredictable.

Four of Thailand’s banks have closed their branches in Laos, due to tighter regulations and higher regulatory costs and declining business activity.

In October 2023, the United Nations warned that transnational criminal gangs are using Southeast Asia’s booming and increasingly digital gambling industry, including in Laos, as a shadow banking system to covertly move and launder ever more dirty money.

Environmental, Social and Governance (ESG) – Stable at 4

The United Nations’ Sustainable Development Goals (SDGs) are recognized as a beneficial framework for responsible investment. The Sustainable Development Report from Cambridge University Press assesses the progress of all 193 UN Member States on the SDGs. It provides a useful means of ranking Southeast Asian countries on their ESG progress.

Laos is ranked 115 out of 166 in the 2023 report with a score of 63.0.

Environment – According to the World Bank, forest loss and degradation have cost the country nearly 3% of GDP per year until recently. However, it adds that the government has taken steps to invest in protecting the country’s forest as a long-term economic asset. In recent years, the lower half of the Mekong, which runs through Thailand, Myanmar, Cambodia, Laos, and Vietnam, has experienced a number of serious droughts that have sent water levels to all-time lows. This is partly due to climate change and the El Nino but dam construction also has an impact, according to ecologists.

Social – Laos scores very lowly in this area. Key areas of concern include freedom of speech, association, and assembly; enforced disappearances; abusive drug detention centres; and repression of minority religious groups, according to Human Rights Watch. Workers have few rights and living standards are among the lowest in the world.

Governance – Laos also rates very poorly in terms of governance with high levels of corruption and very weak rule of law as outlined in the commercial risk section.

February Bulletin

Environmental, Social and Governance (ESG) – Stable at 4

The increased pace of development of dams along the Mekong is focusing attention on the threat these projects pose to Laos’ environment. The dams have a major impact on the river’s hydrology, interconnected ecosystems and sediment flow. They also have implications for the livelihoods of the 60 million people who live in the Lower Mekong Basin. Currently, two dams are operational and seven more are planned in Laos.

Pressing ahead with its vision to become the “Battery of Southeast Asia,” the government appears to be ignoring concerns that the dams could inflict social, economic and environmental damage. UNESCO, for example, has appealed to the government to halt construction of a huge dam just 25 kilometers upstream from the world heritage town of Luang Prabang. The Thai developer has also ignored warnings that it is building the dam in an earthquake-prone zone.

Latest economic data

f forecasts

* World Bank

** Worldbox Intelligence

3 Trading Economics

4 Statista

6 IMF

Source: Asian Development Bank, except where stated

Useful Links

https://www.transparency.org/en/cpi/2021

https://www.imf.org/en/Countries/LAO

https://www.adb.org/countries/lao-pdr/main

About Worldbox Business Intelligence

Worldbox Business Intelligence, headquartered in Switzerland, is a Global API data solution provider of business intelligence and used in data analytics.

With the Global API solution Worldbox Business Intelligence enables clients and partners also a frictionless real time onboarding, KYC and compliance verification while rapid global investigations are provided, if needed.

Worldbox Business Intelligence provides global data in a standardised structure to more than 200 Million companies worldwide. The global network of subsidiaries, branches and desks allows to precisely and efficiently collect data and target key territories for clients and partners.”

“Worldbox Business Intelligence – Bringing Swiss Precision To Data”

Copyright (C) 2024 Worldbox Business Intelligence. All rights reserved.

Our mailing address is:

Worldbox Business Intelligence

Breitackerstrasse 1

Zollikon

Zurich 8702

Switzerland