Worldbox Country Risk Climate – March 2024

Vietnam

Summary

| Overall Risk Score 23 (Stable)

Political risk: Stable 8/10 Economic risk: Stable 8/10 Commercial risk: Stable 7/10 The risk assessment of a country is made up of 3 components, being Political, Economic and Commercial. Each component is scored out of 10 with 1 being the highest risk and 10 the lowest. |

ESG Risk: 6/10 (Stable)*

*Environmental, social and governance (ESG) issues are becoming increasingly important to companies, investors and consumers in Southeast Asia. That is why we are now preparing a separate ESG score and section with our quarterly country risk reports. We explain how each country rates, looking at the E, S and G individually, and outline recent developments. |

Political Risk – Stable at 8

Vietnam is a one-party state ruled by the Communist Party of Vietnam (CPV). The CPV provides strategic direction and decides all major policy issues which the government then implements. The four most important positions in the country are CPV General Secretary, the most powerful position in Vietnam, State President, Prime Minister and National Assembly Chair.

General Party Secretary Nguyen Phu Trong is the most powerful man in the country. He was re-elected to the position of general-secretary of the Communist Party in January 2021, at the age of 76, for a rare third five-year term. Since taking office in 2011, Trong has built up a strong power base in the Communist Party.

Trong launched an anti-corruption campaign in 2016, known as “blazing furnace” that has claimed many politicians and businessmen, including most notably President Nguyen Xuan Phuc who resigned (or more probably was forced from office) in January 2023.

Vo Van Thuong, a close ally of Trong, took over as the country’s president. Some analysts believe the promotion of the relatively youthful Thuong – he is 52 – means he is being positioned to eventually take over as the country’s de facto leader by Trong. Some analysts argue that the corruption drive has simply been used by Trong to eliminate political opponents and consolidate his grip on power.

Economic Risk – Stable at 8

Vietnam’s shift from a centrally planned to a market economy has transformed the country from one of the poorest in the world into one of its most dynamic. Between 2002 and 2022, GDP per capita increased 3.6 times, reaching almost US$3,700, according to the World Bank. It adds that poverty rates (US$3.65/day, 2017 PPP) declined from 14% in 2010 to 3.8% in 2020.

The country’s economic model has been built on attracting foreign investment to drive the transformation from agriculture to a modern economy based on manufacturing. Strong foreign investment and current-account surpluses have strengthened the external position.

An October 2023 report by the S&P rating agency identified five key drivers that are expected to continue to make Vietnam one of the fastest growing emerging markets in the Asian region.

Firstly, S&P said that Vietnam will continue to benefit from its relatively lower manufacturing wage costs relative to coastal Chinese provinces, where manufacturing wages have been rising rapidly over the past decade.

Secondly, the agency added that Vietnam has a relatively large, well-educated labour force compared to many other regional competitors in Southeast Asia, making it an attractive hub for manufacturing production by multinationals.

Thirdly, rapid growth in capital expenditure is expected, which the agency says reflects continued strong foreign direct investment by foreign multinationals. Domestic infrastructure spending will also support growth. The government estimates that US$133 billion of new power infrastructure spending alone is required by 2030. The country has already been affected by severe power shortages as supply struggles to cope with surging demand.

S&P adds that fourthly Vietnam is benefiting from the fallout of the US-China trade war, as higher US tariffs on a wide range of Chinese exports have driven manufacturers to switch production of manufacturing exports away from China towards alternative manufacturing hubs in Asia.

The agency says that many multinationals have been diversifying their manufacturing supply chains during the past decade to reduce vulnerability to supply disruptions and geopolitical events. The COVID-19 pandemic reinforced this trend.

Commercial Risk – Stable at 7

Businesses operating in Vietnam faces some significant challenges according to the US State Department’s 2023 Investment Climate report. These include widespread corruption, the entrenched position of state-owned enterprises (SOEs) in certain sectors, regulatory uncertainty in key sectors, a weak and opaque legal regime, poor enforcement of intellectual property rights, a shortage of skilled labour, restrictive labour practices, and slow government decision-making processes.

The report adds that due to a high reliance on inputs from China, Vietnamese manufacturing is vulnerable to forced labour risks in supply chains, though the government and industry are actively working to address these concerns.

Corruption is a significant challenge. However, progress does seem to be being made. Vietnam ranked in 77th place out of 180 countries in Transparency International’s 2022 Corruption Perceptions Index, up from joint 104th in 2021. According to the Vietnam Corruption Report by GAN, corruption is pervasive in Vietnam’s business environment. It adds that companies are likely to experience bribery, political interference and facilitation payments in all sectors. However, land administration, the construction sector and public administration are especially prone to corruption, according to GAN.

The country ranks in 72nd place in terms of economic freedom, according to the Heritage Foundation’s 2023 Index. It has moved up 12 places since 2022. Vietnam is ranked 14th out of 39 countries in the Asia–Pacific region, and its overall score is above the world and regional averages.

The lack of adequate infrastructure provides significant challenges to operating in Vietnam. Just 20% of the country’s national roads are paved. The population growth in major cities in recent years has strained and exceeded the capacity of the existing infrastructure. Vietnam also lacks adequate infrastructure connecting roads with seaports, resulting in logistics costs being insufficiently competitive.

March Bulletin

Political Risk – Stable at 8

The government faces no significant threats to its rule. Former president Nguyen Phu Trong, who was re-elected to the post of general secretary of the Communist Party in January 2021, is the most powerful figure in the country. Trong is 78 and had health issues – although his health now appears to have improved. Even if Trong were to retire, Vietnam’s political stability would likely be unchanged, given the smooth transition of leadership that has taken place in Vietnam when previous leaders have stepped down. There is also broad support within the Communist Party for the current economic policies that have served Vietnam so well over the past few decades.

The government continues to balance ties with China and the USA. The September visit to Vietnam of US President Biden resulted in the elevation of U.S.-Vietnam diplomatic relations to a comprehensive strategic partnership. This is Vietnam’s highest tier of international partnership, which has also been extended to China and Russia. The two countries also signed deals related to key strategic sectors, such as AI, cloud computing, semiconductors, and new energy. Nikkei Asia concluded the visit “seems to have ushered in a new era of expanded economic links between the two countries.”

Nikkei argued that Biden’s visit may trigger a surge in American investment in Vietnam. It added that “while the U.S. government acknowledges the fact that Vietnam does not necessarily comply with core principles upheld by the U.S., such as democracy and respect for human rights, due to its single-party communist rule, Washington nevertheless perceives Vietnam as a friendly nation that is not part of China’s sphere of influence. Biden’s diplomatic move may be interpreted by American businesses as a green light to invest in Vietnam.”

Japan is also pursuing closer ties with Vietnam, reflecting the two countries’ growing concern over China’s assertive behavior in the region. Japan has signed its own comprehensive strategic partnership with Hanoi to boost security ties and it may begin delivering Japanese military aid to Vietnam.

However, the Council on Foreign Relations publication argues that Chinese President Xi Jinping’s December 2023 visit to Vietnam shows that Hanoi still probably views China as its closest strategic partner. Beijing is by far Vietnam’s dominant trading partner, argues the CFR and that “even with greater military aid from Japan, the United States, or South Korea, Vietnam’s military remains based on Russian platforms, which is why they have continued to try to buy Russian arms despite sanctions”.

Economic Risk – Stable at 8

The economy is set to enjoy a strong rebound in 2024 according to an Asian Development Bank (ADB) report published in December. The ADB forecasts growth will rise to 6% in 2024, up from 5.2% in 2023. Worldbox Intelligence is forecasting a more cautious gain of 5.5% in 2024 given the possibility of a slowdown in global growth in the first half of the year.

The ADB noted that: “Weaker than expected recovery of external demand continued to impede industry and services output, dragging the recovery in jobs and domestic consumption. On the supply side, economic growth is being impeded by lower industry and services output.”

In December 2023, the Fitch ratings agency forecast medium-term growth of around 7%, citing Vietnam’s cost competitiveness and educated workforce relative to peers. It added that entry into regional and global free-trade agreements bodes well for continued strong FDI inflows amid global supply chain diversification.

Vietnam certainly continues to attract very high levels of FDI. Around US$36.61 billion of FDI flowed into the country in the year to 20th December 2023, a rise of 32.1% year on year. Total implemented foreign direct investment was estimated at USD 22.4 billion in 2022. The major investment destinations in 2023 included Ho Chi Minh City, Hai Phong, Quang Ninh, Bac Giang, Hanoi, Bac Ninh, Binh Duong, and Dong Nai. Processing-manufacturing accounted for 64.2% of the total FDI as producers continue to relocate production from China.

In June, the central bank cut interest rates for the fourth time in 2023. The 50 basis points reduction left the refinance rate at 4.5%, the discount rate at 3.0% and the electronic interbank rate at 5.0%. In December 2023, Singapore’s UOB bank forecast that the central bank will maintain its refinancing rate at the current level of 4.5% to support an economic recovery in 2024. HSBC’s global research team also expects the policy rate to remain steady at 4.5% in the whole of 2024 to support economic growth and recovery.

It is important to add a note on recent official economic figures. Nikkei Asia reported in June that skepticism about the statistics released by Vietnam’s central and local governments is spreading, “as gross domestic product and tourism figures show marked improvement despite poor business sentiment”.

The report added that:

“The country’s structural steel industry has been hit hard by plummeting demand from lack of investment and an economic slowdown. Production facilities have seen operating rates fall to about 30%, and steelmakers are in the red. In the capital Hanoi, new buildings that have been abandoned mid-construction are becoming a more common eyesore.”

Nikkei Asia also quoted a source at a Japanese trading house as saying, “business sentiment is worse than during the global financial crisis.”

Nikkei Asia cited official GDP figures for the second quarter showing the economy expanding by an annual 4.14%, surpassing 3.28% growth in the January to March period. The news agency quoted business sources as saying the figures seemed “odd”. Just before the government released the numbers, Standard Chartered forecast GDP growth of 1.5% for the April-June quarter.

Commercial Risk – Stable at 7

In December 2023, the Fitch ratings agency upgraded Vietnam’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘BB+’, from ‘BB’. The Outlook is Stable. Fitch said the upgrade “reflects Vietnam’s favourable medium-term growth outlook, underpinned by robust foreign direct investment (FDI) inflows, which we expect will continue to drive sustained improvements in its structural credit metrics”.

In July, Fitch had expressed concern about the impact of bad debts in the property sector on the government finances. However, in its latest update the agency said that “We have increasing confidence that near-term economic headwinds from property-sector stresses, weak external demand and delays in policy implementation owing to a corruption crackdown are unlikely to affect medium-term macroeconomic prospects and that policy buffers are sufficient to manage near-term risks.”

However, the agency warned that property risks remain in place. It explained that: “Weakness in the property market and slower economic growth have dampened loan demand and contributed to an increase in banks’ asset impairment in 2023. Some highly leveraged firms could face refinancing risks as maturities fall due. Many banks have not reduced real-estate lending or bond holdings significantly, suggesting that they will refinance qualified borrowers to avoid crystallising wider defaults and losses.”

Environmental, Social and Governance (ESG) – Stable at 6

The United Nations’ Sustainable Development Goals (SDGs) are recognised as a beneficial framework for responsible investment. The Sustainable Development Report from Cambridge University Press assesses the progress of all 193 UN Member States on the SDGs. It provides a useful means of ranking Southeast Asian countries on their ESG progress.

Vietnam is ranked 55 out of 166 in the 2023 report with a score of 73.3.

Environment: According to the Intergovernmental Panel on Climate change, Vietnam is one of several countries most vulnerable to climate change. With 3,260 km of coastline, 2,860 rivers and 4,000 islands, Vietnam is dangerously exposed to flooding, typhoons, tsunamis and tropical storms. A recent catastrophe, ‘The 2020 Central Vietnam floods’ saw a death toll of 189 people and damage worth $1.57 billion. The floods were the result of seasonal monsoons and tropical cyclones.

Attempting to combat climate change, the Vietnamese Government has released plans to reach a net-zero emissions target by 2050. It hopes to increase the country’s renewable energy usage by 67.5%, and pledges to build no new coal-fired power stations post 2030. English-language newspaper, Viêt Nam News claims ‘Coal and gas thermal powers reach 42.7 per cent of energy provided, while turbines are 11.2 per cent and hydroelectric 27.4 per cent’, as of February 2023.

Social: The US State Department Human Rights report for 2022 outlines a number of human rights abuses. The Vietnamese government responded by saying the report contained “unobjective comments based on inaccurate information about the actual situation in Vietnam.”

In terms of worker’ rights, Vietnam adopted an amended Labour Code in January 2021. It is aimed at aligning labour rules with international labour standards asset out by the International Labour Organization.

Governance: Corporate governance is a relatively new concept in Vietnam. The government has taken important measures to improve its ownership and corporate governance frameworks for state-owned enterprises (SOEs), according to an OECD report published in 2022. SOEs account for one-third of GDP and dominate many of the sectors such as energy, transport, telecommunications and finance. The country’s SEC launched the Vietnam Corporate Governance Code of Best Practices in 2019 for the private sector. It draws upon the draws upon the G20/OECD Principles of Corporate Governance, the 2017 ASEAN Corporate Governance Scorecard, as well as the most recent corporate governance codes of countries around the world.

March Bulletin

Environmental, Social and Governance (ESG) – Stable at 6

Research data indicates that Vietnamese businesses are becoming increasingly aware of ESG as a means to attract foreign investment, while consumers are also starting to make purchase decisions based on the brand’s commitment to ESG. That’s according to a November report by Viet Nam News. It added that increasing numbers of Vietnamese firms have been taking a proactive stance in reducing carbon footprint, waste and engaging in socially responsible business practices to meet Vietnam’s ESG standards.

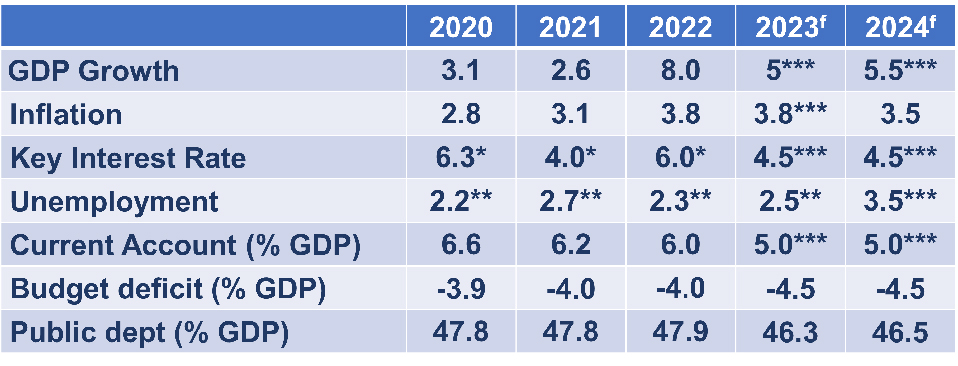

Latest economic data

f – forecasts

* – State Bank of Vietnam

** – Statista

*** – Worldbox Intelligence

Source: International Monetary Fund, except where stated

Useful Links

https://www.transparency.org/en

https://www.imf.org/en/Countries/VNM

About Worldbox Business Intelligence

Worldbox Business Intelligence, headquartered in Switzerland, is a Global API data solution provider of business intelligence and used in data analytics.

With the Global API solution Worldbox Business Intelligence enables clients and partners also a frictionless real time onboarding, KYC and compliance verification while rapid global investigations are provided, if needed.

Worldbox Business Intelligence provides global data in a standardised structure to more than 200 Million companies worldwide. The global network of subsidiaries, branches and desks allows to precisely and efficiently collect data and target key territories for clients and partners.”

“Worldbox Business Intelligence – Bringing Swiss Precision To Data”

Copyright (C) 2024 Worldbox Business Intelligence. All rights reserved.

Our mailing address is:

Worldbox Business Intelligence

Breitackerstrasse 1

Zollikon

Zurich 8702

Switzerland