Indonesia’s economic ascent to continue following presidential election Indonesia’s election commission has confirmed Prabowo Subianto as the nation’s next president. Adrian Ashurst, CEO of Worldbox Intelligence, believes Prabowo will maintain the successful economic course plotted by his predecessor, Joko Widodo.

Defence Minister Prabowo and his vice-presidential running mate, Gibran Rakabuming Raka, won 59% of the votes cast on 14 February. His two rivals – Anies Baswedan, who secured 25% of the total count, and Ganjar Pranowo, who received 16% – have promised to file a legal complaint alleging irregularities during the campaign. Given the scale of Prabowo’s victory, it is difficult to see these making much headway. If the legal challenges do fall away, Prabowo is expected to take over from Jokowi, as the president is commonly called, in October.

Steady as she goes

Prabowo has said he will continue Jokowi’s’s major policies, including moving the country’s capital from Jakarta to the island of Borneo, and developing a domestic mineral-processing industry rather than shipping lower-value raw materials abroad.

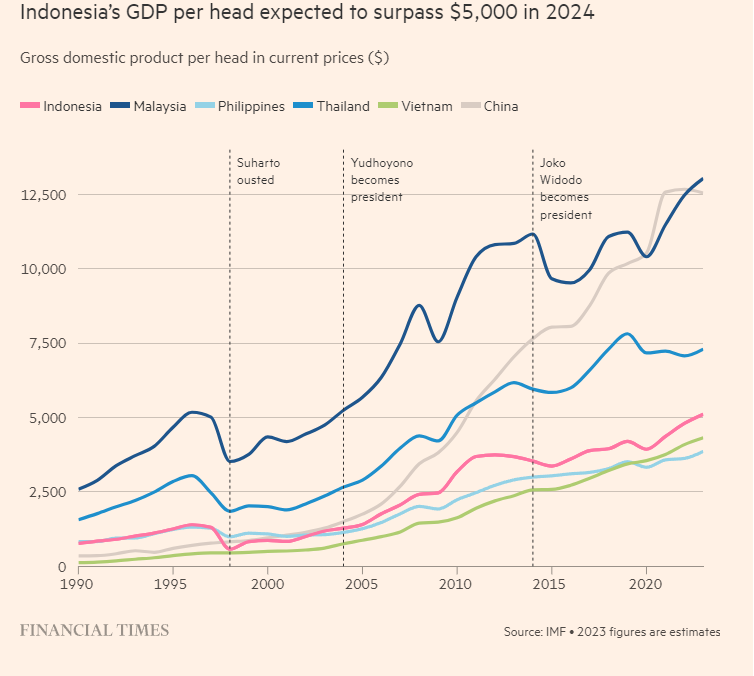

That continuity should spell good news for Indonesia. Helped by business-friendly policies and an infrastructure push under Jokowi, the country has become one of the world’s most attractive emerging markets and investment destinations, according to the Financial Times1. Its economy has grown by around 5% annually over the past decade, except during the Covid-19 pandemic.

Prabowo has pledged to increase that rate to 8% within the next four to five years by slashing economic inefficiencies and pursuing investor-friendly policies. He has also vowed to maintain the country’s fiscal discipline. However, Prabowo’s election campaign pledges – such as a plan to give out free school lunches and milk to more than 80 million children and over 4 million expectant mothers annually – have spooked foreign investors.

Electoral pledges spark foreign investor concern

Prabowo’s spending spree could amount to around US$29 billion, or more than the entire 2023 budget deficit. Prabowo also sparked alarm during an election debate in January when he remarked that he would have “no problem” with letting Indonesia’s debt-to-GDP ratio touch 50%, up from nearly 40% at present.2

By 21 March, global funds had withdrawn around US$1.1 billion from Indonesian bonds since balloting closed on 14 February. Ratings agencies have added to the criticism, warning that Prabowo’s spending plans could impact the nation’s credit rating.

There is further concern about who Prabowo will appoint as his finance minister. Sri Mulyani Indrawati, a former managing director of the World Bank who has been in office since 2016, is expected to leave after her term under Jokowi ends. The well-respected finance minister has reportedly disagreed with Prabowo over a number of issues, including military-equipment procurement and social welfare.

Figure 1: GDP per capita growth has accelerated under Jokowi

1. https://www.ft.com/content/4e09f403-0e17-47e6-96ec-00fe0cb6a5c1

2. https://asia.nikkei.com/Politics/Indonesia-election/Prabowo-s-call-on-Indonesia-s-finance-chief-worries-investors

Prabowo unlikely to change tack from Jokowi’s course

However, despite these concerns, Worldbox Intelligence anticipates that Prabowo will maintain Jokowi’s relatively conservative fiscal policies. Prabowo certainly wouldn’t be the first politician to row back on election campaign promises. He is also likely to come under pressure from Jokowi, who still exerts considerable influence and has ambitions to create a political dynasty, to ensure his legacy of economic success remains intact. Jokowi’s son, the 36-year-old Gibran Rakabuming Raka, elected as vice president, will certainly be keen to ensure he has a successful economic foundation to build on when launching his own presidential bid down the line. The 72-year-old Prabowo may only serve one term in office given his age.

Moreover, Indonesia benefits from various structural drivers that should ensure the economy continues to grow strongly, allowing Prabowo to fund at least some, if not most, of his election commitments relatively painlessly. These drivers include:

- A growing middle class that is fuelling consumption – household consumption accounts for more than half of Indonesia’s GDP but has plenty of scope for growth, given the figure is around 60–70% in the advanced economies

- A young and expanding labour force

- The country’s strategic position as one of the largest and most populous economies in Asia, which should help it to exploit trade liberalisation in the region

- The country’s initiation of some significant measures aimed at fostering domestic and international trade liberalisation in recent years

- The policy of seeking to add value to the country’s abundance of raw materials, which appears to be meeting with success.

The last of these points is highlighted by the government’s ability to attract significant FDI to realise its ambitions of becoming an electric-vehicle (EV) production hub, leveraging the country’s vast nickel reserves, an important material for EV batteries.

The country certainly remains highly attractive to foreign direct investors

Indonesia recorded a total of 744 trillion rupiah (US$47.34 billion) of foreign direct investment in 2023, up 13.7% on an annual basis, underscoring the country’s appeal. The base-metal industry was the biggest recipient, at US$11.8 billion, while mining was in fourth place, with US$4.7 billion, helped by the EV drive. However, warehousing, telecommunications, pharmaceuticals, and pulp and paper also received heavy investment, underlining the country’s transition away from a reliance on raw materials.

Economic growth potential remains untapped

There is also plenty of scope for Prabowo to initiate reforms that could raise the country’s growth potential. The IMF, for example, has called for energy subsidy reform. It noted that such reforms are essential to change incentives in the energy sector, help achieve climate objectives, improve the government’s fiscal position, and support Indonesia’s development agenda. The organisation added that investment infrastructure is required to alleviate bottlenecks, and that further impetus is required in reducing labour-market restrictions, improving the investment climate, boosting human-capital development, and developing the financial system. The government has already initiated reforms to the labour market and financial sectors.3

3. https://www.imf.org/en/Publications/CR/Issues/2023/06/22/Indonesia-2023-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-535060

Overall, Indonesia’s short- and long-term prospects appear sound. Most analysts anticipate growth of around 5% this year, and that level of growth – at a minimum – appears achievable over the long term. A successful reform programme and continued fiscal and monetary discipline could well raise the economy’s growth potential to the 6–8% level.

Source: Worldbox Press Release

About Worldbox Business Intelligence

Worldbox Business Intelligence, headquartered in Switzerland, is a Global API data solution provider of business intelligence and used in data analytics.

With the Global API solution Worldbox Business Intelligence enables clients and partners also a frictionless real time onboarding, KYC and compliance verification while rapid global investigations are provided, if needed.

Worldbox Business Intelligence provides global data in a standardised structure to more than 200 Million companies worldwide. The global network of subsidiaries, branches and desks allows to precisely and efficiently collect data and target key territories for clients and partners.”

“Worldbox Business Intelligence – Bringing Swiss Precision To Data”

Copyright (C) 2024 Worldbox Business Intelligence. All rights reserved.

Our mailing address is:

Worldbox Business Intelligence

Breitackerstrasse 1

Zollikon

Zurich 8702

Switzerland