Highlights: Record First Quarter Revenues, Operating Income and Cash Flow; FNC Acquisition Completed

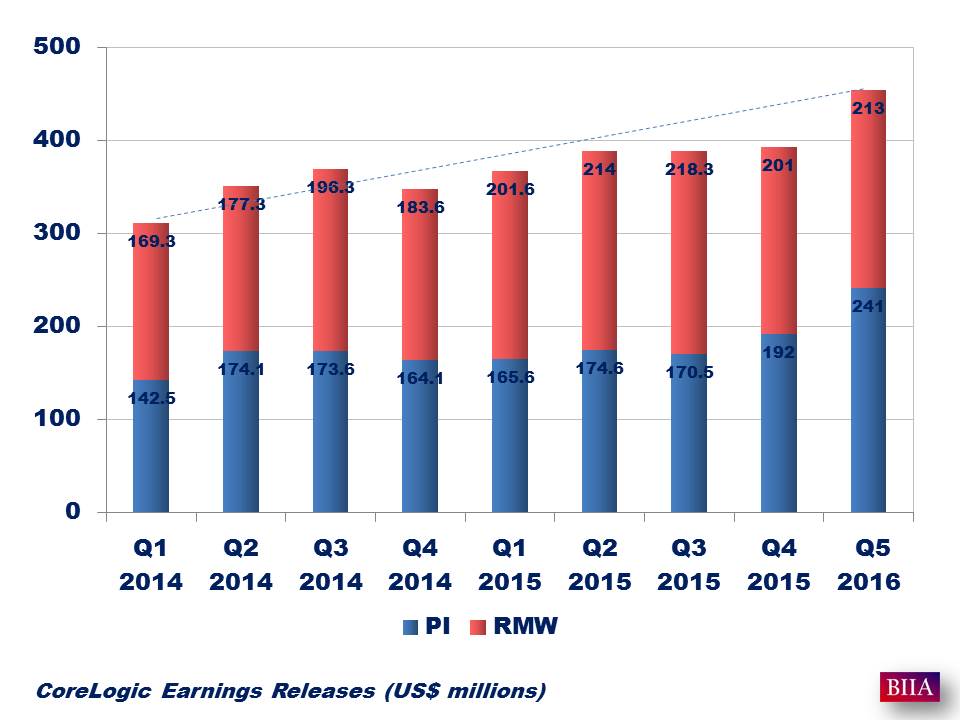

Revenues up 24% to $454 million driven primarily by Valuation Solutions Group (VSG) launch and Risk Management and Workflow (RMW) market outperformance offset by lower U.S. origination volumes and unfavorable currency translation.

Revenues up 24% to $454 million driven primarily by Valuation Solutions Group (VSG) launch and Risk Management and Workflow (RMW) market outperformance offset by lower U.S. origination volumes and unfavorable currency translation.- Operating income from continuing operations up 16% to $57 million as higher revenue and cost reduction program benefits offset acquisition-related transaction and integration costs, severance and currency translation.

- Net income from continuing operations down 6% to $28 million on higher income tax provisions. Diluted EPS from continuing operations of $0.31, comparable to prior year. Adjusted EPS up 4% to $0.48 per share.

- Adjusted EBITDA up 5% to $106 million.

- Company closes acquisition of FNC, Inc. (FNC) and confirms a full-year repurchase target of at least 2 million common shares.

“CoreLogic is off to a strong start in 2016. Over the first three months of the year, we delivered significant top line growth and record free cash flow. Despite an estimated 10% decline in U.S. loan originations, we also increased adjusted EBITDA and adjusted EPS while reinvesting for sustained stakeholder value creation,” said Anand Nallathambi, President and Chief Executive Officer of CoreLogic. “Importantly, we are continuing to focus on scaling our market leading property intelligence, underwriting and risk management operations which provide “must have” insights, analytics and data-enabled services that help our current and future clients in the real estate ecosystem to more precisely underwrite and manage their risks and capitalize on opportunities as they arise.”

“Operationally we are continuing to execute strongly against our strategic and tactical business plans. Successfully closing the FNC transaction represents another key milestone in the build out of the VSG which we believe offers all of our stakeholders a unique value catalyst and an opportunity for strategic growth and leadership in a highly-fragmented and challenged market space,” added Frank Martell, Chief Operating Officer of CoreLogic. “We are also continuing to reap the benefits of our ongoing commitment to driving cost productivity, efficiency and free cash flow. Our high sustainable cash flow conversion rates allow us to target a significant level of share repurchases over the balance of 2016.”

Source: CoreLogic Earnings Release