Worldbox Intelligence Risk Rating May 2023

THAILAND

Overall Score 20 – Stable

Political risk: Stable 6/10

Economic risk: Stable 7/10

Commercial risk: Stable 7/10

The risk assessment of a country is made up of 3 components, being Political, Economic and Commercial. Each component is scored out of 10 with 1 being the lowest risk and 10 the highest.

Political Risk – Stable at 6

Political uncertainty remains at high levels in Thailand following the 14th May election. In a stunning setback for the military, the reformist-minded Move Forward party exceeded every prediction to win 151 of the 500 seats in the lower house. Pheu Thai, the second-largest party, led by ex-prime minister Thaksin Shinawatra’s daughter, has said it has agreed to join Move Forward and four smaller opposition parties. The coalition would have more than 60% of seats in the new parliament.

However, the coalition’s path to power contains many obstacles. They include the 250-strong unelected senate, which was appointed by the current prime minister Prayuth Prayuth Chan-ocha, who led a coup that ousted an elected government in 2014. The senate is likely to object to Move Forward’s agenda, in particular its pledge to amend the controversial lese majeste law and role back the role of the military in Thailand. Move Forward also wants to reform the miliary and reduce its budget.

Another military coup is unlikely, but the military could seek a court ruling to disqualify Move Forward on a technicality, as happened to its predecessor Future Forward in 2020. The huge vote in favour of the reformist parties, however, gives them a clear mandate which it will be difficult for the royal and military-dominated establishment to ignore. Any attempt to block the parties taking power will almost certainly result in widespread street protests.

In former times, the king and his advisers could have played a crucial role in brokering any deal between the Move Forward-led coalition and the military. However, while the current king Vajiralongkorn remains a powerful figure, he does not command the respect given to his father King Bhumibol Adulyade, who died in 2016.

It could take 60 days before a prime ministerial candidate is endorsed by Thailand’s combined houses of parliament. Move Forward and its allies are likely to spend the coming weeks trying to persuade members of the senate to join forces with them. The military and the royal family meanwhile will doubtless be trying to assess whether they can risk blocking the reformists from taking power. That would be a very dangerous move but the military has shown few qualms about ignoring popular opinion in the past.

Economic Risk – Stable at 7

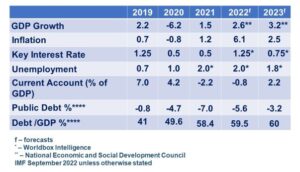

The outlook for the economy continues to improve, hence our positive outlook. Forecasts for economic growth in 2023 vary from 3.4% (DBS Bank) to 4.5% (Standard Chartered). Sharply rising tourism numbers and China’s re-opening are likely to offset slower exports – reflecting weaker global demand. Thailand is heavily reliant on international tourism, which once accounted for around 22% of national income, and was battered by the pandemic. Tourism is reviving with over 11 million foreign tourists arriving in 2022. The Tourism Authority of Thailand is targeting 25 million visitors in 2023, still way below the 39 million international arrivals seen in 2019. Chinese tourists accounted for over a quarter of the overall number of overseas visitors to Thailand in 2019.

However, positive changes that point to a rebalancing of the economy appear to be underway. Foreign investment is rising and exports surged towards record levels in 2021, led by autos and autoparts, iron and steel products, IT equipment and chemicals. That helped the country record an annual trade surplus of US$3.57 billion. Exports slowed sharply in 2022 and are forecast to remain weak in 2023 reflecting the global growth slowdown.

Thailand is benefiting from Sino-US trade tensions with foreign and Chinese companies shifting production from China to countries such as Thailand, particularly in the automotive and parts, electronics, and platform and digital information cloud services industries.

Thailand offers many particular attractions as an alternative source of production to China. It is home to the second largest domestic market in Southeast Asia, which has been growing rapidly for decades. It is already one of Asia’s major automotive, electronics and petrochemical production hubs with relatively good infrastructure and an attractive business climate in terms of the Ease of Doing Business and receptiveness to foreign direct investment (FDI).

FDI rose by 36% to over US12.3 billion in 2022. China was the biggest foreign investor, followed by Japan, the US, Taiwan (China) and Singapore.

An increase in FDI in tech sectors and more projects in the bio-, circular and green industries, as well as a continued focus on the power generation sector are leading growth. The Thai Board of Investment says is seeing constant growth in foreign investments in sectors such as smart electronics, speciality chemicals, bioplastics and the medical cluster.

The government is keen to attracting high-tech industries, offering tax holidays of as long as 13 years for investments in biotechnology and electric vehicles in its attempt to lure higher-paying jobs and innovation. However, FDI remains below the levels seen before the military seized power in 2014 to install Mr Prayut Chan-o-cha – US$13billion of FDI flowed into the country in 2013.

The economy also continues to face long-term challenges that were evident before the pandemic, reports the IMF. In its 2022 Article IV Consultation, the IMF described the economic recovery as weak and uneven across sectors, with inflation rapidly rising driven by energy prices. It added that the pandemic had brought to the fore the urgency for Thailand to identify new growth drivers to reverse the pre-pandemic trend of declining productivity growth and meet the challenges of the post-pandemic world.

Commercial Risk – Stable at 7

The country ranked 101st out of 180 countries in Transparency International’s 2022 Corruption Perceptions Index, moving up three places from 2021. Regionally, Thailand lies behind Vietnam in 77th place, Malaysia ranked (61st), and Singapore (5th). According to Thailand’s National Anti-Corruption Commission (NACC), the government is still unable to tackle corruption in government bureaucracy, with rampant graft among state officials in budget management, conflicts of interests and lax law enforcement.

The country ranks 70th in terms of economic freedom, according to the Heritage Foundation’s 2022 index, down from 42nd in 2021. Dragged down by lower scores for business freedom, trade freedom, and rule of law, Thailand has recorded a 3.0-point overall loss of economic freedom since 2017 and has fallen from the top half to the lower ranks of the “Moderately Free” countries. Fiscal health is strong, but the rule of law is generally weak, says the Heritage Foundation.

The Thai government has invested heavily in expanding and improving its infrastructure networks over the past decades. Severe road congestion remains a problem in Bangkok, which accounts for half of Thailand’s GDP, but the country has made significant strides in improving its digital infrastructure. Since the beginning of the COVID-19 pandemic, mobile internet speeds have improved by 81% and now average 40.79 Mbps, according to an analysis by Surfshark. At the same time, broadband speeds have increased by 29% and now average 189.54 Mbps – the second best in the world. According to Surfshark’s Digital Quality of Life Index for 2022, Thailand ranks third in Southeast Asia (behind Singapore and Malaysia) in terms of internet affordability, internet quality, e-infrastructure, e-security and e-government.

May Bulletin

Political Risk – Stable at 6

Despite the overwhelming support for reformist parties at the May general election, the odds remain stacked against them taking power. Under the country’s constitution, drafted by the military Thailand’s unelected 250-seat senate is chosen entirely by the military and has previously voted for a pro-military candidate.

To form a government, a party needs a majority of the combined houses – 750 seats – to elect a prime minister. That means opposition parties need 376 votes across the combined chambers. If they wish to overrule the Senate, that number must come from the lower chamber alone. At present, however, Move Forward can count on just 313 votes at the most. Around 14 senators have also said they would back the coalition.

The Move Forward Party has shown it is willing to be flexible as it seeks to gain power. It has said coalition partners need not support its stance on amending the royal defamation law, for example. The fear is that a protracted period of political instability could still ensue however. The miliary could use that as an excuse to once again step in and take power.

Economic Risk – Stable at 7

The economy suffered a surprise setback in the fourth quarter of 2022, growing by an annual pace of just 1.4%, having expanded by 4.5% in the previous quarter. A steep drop of 10.5% (year on year) in exports was the chief cause. Danucha Pichayanan, secretary-general at the National Economic and Social Development Council (NESDC) explained: “The global economy has decelerated faster than we expected.”

However, the NESDC added that it believed the economy would continue to grow and that recession would be avoided in 2023. Economic growth in 2022 was revised down to 2.6% and the forecast for 2023 lowered to 3.2% from the previous 3.5%.

Siam Commercial Bank’s Economic Intelligence Center (EIC) also believes that Thai economy will enjoy positive growth this year, bolstered by the reopening of China and the recovery of the European economies. The EIC predicts that the number of foreign tourists will rise to 30 million this year, of which Chinese visitors are estimated to be at least 4.8 million. The EIC forecasts that Thailand’s GDP will expand by 3.4% this year and exports would grow 1.2% with China’s revival a key factor – China is one of Thailand’s largest export markets. Thai exports to mainland China and Hong Kong had dropped 8.97 percent last year in dollar terms.

The Bank of Thailand (BOT) increased its policy rate by 25 basis points to 1.5 percent in January, the fourth consecutive rate hike since August last year. Higher borrowing costs are proving particularly difficult for lower-income groups, already burdened by high debt. Thailand’s household debt remains high at 14.9 trillion at end Q3/2022, accounting for 87% of GDP.

However, price pressures do seem to be easing – the headline consumer price index (CPI) fell to 3.79% in February from a year ago, the lowest since January 2022. Easing energy and food prices should slow inflation further but it is likely to remain well above the central bank’s target range of 1% to 3%, suggesting the central bank will raise its key interest rate further.

In June 2022, Fitch Ratings Fitch forecast the general government deficit would gradually narrow to 5.3% of GDP in the fiscal year ending-September 2022, and 3.7% the following year, from an estimated 7.0% in fiscal 2021. A narrower fiscal deficit reflects stronger revenue collection and a measured unwinding of pandemic-related economic relief measures. Thailand’s public debt is expected to stand at 60.43% of gross domestic product at the end of the fiscal year 2023 (ending on 30th September) still within an approved limit of 70% of GDP.

Commercial Risk – Stable at 7

Thai banks’ non-performing loans stood at 2.73% of total lending at the end of December 2022, down from 2.77% at the end of September, helped by debt restructuring, according to the central bank. The BOT added that the banking system remains strong with high levels of capital, loan-loss provisions and liquidity and was able to support the economic recovery and future lending.

Useful Links

https://www.transparency.org/en/cpi/2021

https://www.imf.org/en/Countries/THA

https://www.adb.org/countries/thailand/main

About Worldbox Business Intelligence

An independent service, Worldbox Business Intelligence provides online company credit reports, company profiles, company ownership and management reports, legal status and history details, as well as financial and other business information on more than 50 million companies worldwide, covering all emerging and major markets.

Worldbox was founded in the 1980s, with the vision to become a global business provider. Its ability to deliver data in multiple languages in a standard format has strengthened its brand.

Copyright (C) 2022 Worldbox Business Intelligence. All rights reserved.

Our mailing address is:

Worldbox Business Intelligence

Breitackerstrasse 1

Zollikon

Zurich

Switzerland