Worldbox Intelligence Risk Rating December 2022

THAILAND

SUMMARY

Political risk: Stable 6/10

Economic risk: Stable 7/10

Commercial risk: Stable 7/10

The risk assessment of a country is made up of 3 components, being Political, Economic and Commercial. Each component is scored out of 10 with 1 being the highest risk and 10 the lowest.

Political Risk – Stable at 6

Political uncertainty remains at high levels in Thailand. In September 2022, the country’s Constitutional Court ruled that Prime Minister Prayuth Chan-Ocha, who it suspended in August, had not exceeded the maximum eight years allowed in the post, paving the way for his likely return to power. The former army chief first took power in a 2014 coup and stayed on following an election in 2019. The court issued its September ruling after deliberating on whether Prayuth had exceeded an eight-year term limit added into the post-coup constitution. That provision was intended to prevent popular elected leaders from holding power too long, particularly after the army forcibly removed Thaksin Shinawatra in 2006 and his sister, Yingluck Shinawatra, in 2014.

Opposition parties have continually questioned the legitimacy of Prayut, who seized power in the 2014 military coup, but the Constitutional Court decision was surprising, given that its members are largely picked by a military-appointed Senate. There have been regular street protests demanding a new constitution, the dissolution of parliament, a halt to perceived intimidation of political dissidents, and reform of the monarchy.

The court’s move decision to suspend Prayuth fuelled speculation that Thailand’s royal establishment and elements of the military are looking to replace Prayuth ahead of the next general election, which must be held by March 2023. The military-backed coalition will face a serious challenge from the Pheu Thai party (PTP) backed by former prime minister Thaksin, whose allies have won the most seats in every national vote over the past 21 years. Thaksin is widely regarded as the de facto leaders of the PTP, the largest individual party in the lower house of parliament. Polls show Prayuth is deeply unpopular with the economy headed for the slowest expansion in Southeast Asia this year.

Meanwhile, the divisions between the Red Shirts and Yellow Shirts, that has dominated Thai politics in recent decades is fading. The Red shirts began as supporters of deposed former Prime Minister Thaksin Shinawatra, who was ousted by a military coup in September 2006. This support transferred to the PTP, while the Yellow-shirts represent those opposed to Mr Thaksin and they were the force behind the street protests that led to the 2006 coup. Most Thais are now simply united against the current authoritarian “hybrid democracy”, where military and ex-military leaders exert significant control.

Economic Risk – Stable at 7

The outlook for the economy is improving despite Thailand’s reliance on international tourism, which once accounted for around 22% of national income, and was battered by the pandemic. Tourism is reviving and over 10 million foreign tourists arrived in 2022 and numbers forecast to rise to 20 million next year, according to the Tourism Authority of Thailand. However, these numbers pale in comparison to the 39 million international arrivals seen in 2019. Chinese tourists accounted for over a quarter of the overall number of overseas visitors to Thailand in 2019 and until recently no change was expected in the numbers for 2023. However, following China’s recent announcement of easing restrictions on international flights the Tourism Authority of Thailand has increased their estimates for international arrivals to 25 million for 2023.

However, positive changes that point to a rebalancing of the economy appear to be underway. Foreign investment is rising and exports are surging towards record levels. Exports rose by 17.1% in 2021, the highest growth seen in 11 years, led by autos and auto parts, iron and steel products, IT equipment and chemicals. That helped the country record an annual trade surplus of US$3.57 billion.

A number of factors explain Thailand´s export-led manufacturing rebound, and its growing appeal to investors. The depreciation of the Thai baht has boosted competitiveness as global trade accelerates from the severe pandemic associated lockdowns of 2020.

Thailand is also benefiting from Sino-US trade tensions with foreign and Chinese companies shifting production from China to countries such as Thailand, particularly in the automotive and parts, electronics, and platform and digital information cloud services industries.

Thailand offers many particular attractions as an alternative source of production to China. It is home to the second largest domestic market in Southeast Asia, which has been growing rapidly for decades. It is already one of Asia’s major automotive, electronics and petrochemical production hubs with relatively good infrastructure and an attractive business climate in terms of the Ease of Doing Business and receptiveness to foreign direct investment (FDI).

The latest figures certainly suggest investment in Thailand is booming. The combined value of foreign and local applications for investment in 2021 rose by 59% to 643 billion baht. This was led by an increase in FDI in tech sectors and more projects in the bio-, circular and green industries, as well as a continued focus on the power generation sector. FDI accounted for around 71% of total investment with Japan, China and Singapore being the main sources of these funds. The Thai Board of Investment said it was seeing constant growth in foreign investments in sectors such as smart electronics, speciality chemicals, bioplastics and the medical cluster.

However, the economy continues to face long-term challenges that were evident before the pandemic, reports the IMF. In its 2022 Article IV Consultation, the IMF described the economic recovery as weak and uneven across sectors, with inflation rapidly rising driven by energy prices. It added that the pandemic had brought to the fore the urgency for Thailand to identify new growth drivers to reverse the pre-pandemic trend of declining productivity growth and meet the challenges of the post-pandemic world.

The IMF structural challenges required well-coordinated efforts to upskill Thailand’s labour force. It called for increased investments in digital infrastructure and R&D, and the easing of business regulations to enable Thailand to capitalize on the growth opportunities of the digital and green transformations and meet the needs of the post pandemic economy.

Commercial Risk – Stable at 7

Thailand has made significant gains in the World Bank’s Ease of Doing Business index in recent years, rising to 21st position out of 190 economies in 2020, from 46th position in 2016. That is considerably better than the average emerging and developing Asian country rating of 95. However, Thailand remains less competitive than its neighbours Malaysia (in 12th position) and Singapore (2nd), partly due to gaps in educational outcomes and labour skills shortages.

The country ranked 104th out of 180 countries in Transparency International’s 2021 Corruption Perceptions Index. Thailand tied with Vietnam in 104th place, two spots behind Indonesia. Malaysia ranked 57th, with a score of 51 points. Thailand was placed ahead of the Philippines (115th), Laos (134th), Myanmar (137th) and Cambodia (160th) in Southeast Asia.

A national survey in 2017 found that almost 80 percent of Thais believed most or all of the police force was corrupt, while half of Thais felt that most or all local government councillors were corrupt. Businesses and individuals reportedly commonly pay irregular payments and bribes in order to obtain favourable judicial decisions.

The country ranks 42nd in terms of economic freedom, according to the Heritage Foundation’s 2021 index. Its overall score increased by 0.3 points, primarily because of an improvement in business freedom. Thailand is ranked 9th among 40 countries in the Asia–Pacific region, and its overall score is above the regional and world averages.

The Thai government has invested heavily in expanding and improving its infrastructure networks over the past decades. Severe road congestion remains a problem in Bangkok, which accounts for half of Thailand’s GDP, but the country has made significant strides in improving its digital infrastructure. Since the beginning of the COVID-19 pandemic, mobile internet speeds have improved by 81% and now average 40.79 Mbps, according to an analysis by Surfshark. At the same time, broadband speeds have increased by 29% and now average 189.54 Mbps – the second best in the world. According to Surfshark’s Digital Quality of Life Index for 2022, Thailand ranks third in Southeast Asia (behind Singapore and Malaysia) in terms of internet affordability, internet quality, e-infrastructure, e-security and e-government.

November Bulletin

Political Risk – Stable at 6

The political environment will remain tense in the run up to the May 2023 general election. Protests against the court ruling allowing Prime Minister Prayut Chan-ocha to stay in office took place in September and October. However, hundreds of people took part rather than the thousands seen in earlier demonstrations calling for a change in government.

Meanwhile, an estimated two thousand protested in November in Bangkok in response to a court ruling that said demands to reform the monarchy were illegal. The Constitutional Court also ruled that three anti-government activists aimed to overthrow the monarchy in speeches made in August 2020.

Thailand’s digital economy minister, Chaiwut Thanakamanusorn, warned in September that another military coup could take place if protests escalate. However, the relatively small numbers of people taking to the street has surprised political analysts expecting much higher numbers. Some have speculated that the costs of living crisis means that Thais are simply focused on surviving economically rather than paying attention to politics.

Economic Risk – Stable at 7

The economy grew at its fastest pace in a year in the third quarter of 2022, expanding at an annual pace of 4.5% as a revival in tourism, increased consumption and a pick-up in private investment boosted growth. The state planning agency, the National Economic and Social Development Council (NESDC), said that the economy would grow by 3.2% in 2022, up slightly from the 2.7% to 3.2% prediction announced in August. For 2023, the NESDC projects 3% to 4% growth.

As ever there are risks to this forecast. The NEDC warned that these include “slower-than-expected global economic growth and volatility in global financial markets as major central banks continue to raise interest rates to reduce still high inflationary pressures.”

Thai exports continued to grow strongly in the third quarter and the government anticipates 8% growth overall in 2022. Exports rose by 10.6% over the first nine months of the year to US$221bn, while imports increased by 20.7% to US$236 billion. The baht’s depreciation against the dollar, falling freight costs and a pickup in global demand – post the pandemic-related lockdowns – have helped boost growth in 2022. Industrial products, particularly automobiles, computers and electronics were among the fastest-growing sectors.

In August 2022, the Bank of Thailand (BOT) raised interest rates by 25 basis points, the first increase since 2018, to 0.75%, and by a further 25 basis points to 1% in September. The BOT has been one of the least hawkish central banks in Southeast Asia and an easing in Thai headline inflation and a strengthening of the baht in the third quarter has provided policy makers with scope to adopt a cautious approach to monetary tightening, while supporting the economy’s recovery.

Consumer prices fell for the second consecutive month in October as energy and food prices continued to ease. The CPI reached an annual rate of 5.98% on an annual basis, down from a 6.41% increase in September.

In June 2022, Fitch Ratings Fitch forecast the general government deficit would gradually narrow to 5.3% of GDP in the fiscal year ending-September 2022, and 3.7% the following year, from an estimated 7.0% in fiscal 2021. A narrower fiscal deficit reflects stronger revenue collection and a measured unwinding of pandemic-related economic relief measures. Thailand’s public debt is expected to stand at 60.43% of gross domestic product at the end of the fiscal year 2023 (ending on 30th September) still within an approved limit of 70% of GDP.

Household debt has increased to almost 90% of GDP from 80% pre-pandemic. Although the ratio eased slightly in the second quarter, it remains the highest in Southeast Asia, making it difficult for the government to stimulate the economy.

Commercial Risk – Stable at 7

In October 2022, Fitch analysts were reported as expecting the recovery in the Thai economy to support continued earnings growth for domestic Fitch-rated corporates in 2023. Most sectors, including food and retail, telecoms, and cement and building materials, should see earnings improve to above pre-pandemic levels in 2023. High oil prices and energy costs hinder earnings improvement for the petrochemical and utilities sectors, where the ability to pass on cost increases is limited.

Fitch added that earnings in the Thai banking sector were poised to continue to improve, driven by the economic recovery and reduced, albeit still-elevated, provisioning. Fitch expects impaired loans to rise as pandemic-relief measures taper off and higher interest rates add to the incremental asset-quality risks. However, asset-quality risks should be contained given the expected moderate pace of monetary tightening in Thailand. In addition, Thai banks have built loan loss reserves and capital buffers, both of which are rating strengths according to the agency.

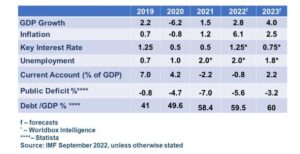

Latest economic data

About Worldbox Business Intelligence

An independent service, Worldbox Business Intelligence provides online company credit reports, company profiles, company ownership and management reports, legal status and history details, as well as financial and other business information on more than 50 million companies worldwide, covering all emerging and major markets.

Worldbox was founded in the 1980s, with the vision to become a global business provider. Its ability to deliver data in multiple languages in a standard format has strengthened its brand.

Copyright (C) 2022 Worldbox Business Intelligence. All rights reserved.

Worldbox Business Intelligence

Breitackerstrasse 1

Zollikon

Zurich 8702

Switzerland