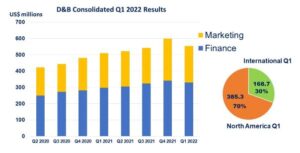

Dun & Bradstreet Holdings, Inc. (NYSE: DNB), GAAP Revenue and Adjusted Revenue for the first quarter of 2022 were both $536.0 million.

GAAP Revenue increased 6.2% and 7.9% on a constant currency basis compared to the first quarter of 2021. Adjusted Revenue increased 5.3% and 6.9% on a constant currency basis compared to the first quarter of 2021.

Excluding the impact of acquisitions and divestitures, organic revenue, before the effect of foreign exchange, was $528.8 million, an increase of 4.5% compared to first quarter of 2021.

GAAP Net loss for the first quarter of 2022 was $31.3 million, or diluted loss per share of $0.07, compared to net loss of $25.0 million or diluted loss per share of $0.06 for the prior year quarter. Adjusted net income was $102.5 million, or adjusted diluted earnings per share of $0.24, compared to adjusted net income of $97.8 million, or adjusted diluted earnings per share of $0.23 for the prior year quarter.

Adjusted EBITDA for the first quarter of 2022 was $190.1 million, up 2.4% compared to the first quarter of 2021, and adjusted EBITDA margin was 35.5%.

“We are pleased with our solid start to the year, as we delivered organic growth of 4.5 percent during the first quarter with balanced performance across both our North America and International business segments,” said Anthony Jabbour, Dun & Bradstreet Chief Executive Officer. “We are executing well, our investments are paying off and we remain confident in our ability to deliver on our full year 2022 goals, advance our long-term strategy, and deliver increased shareholder value.”

“We are pleased with our solid start to the year, as we delivered organic growth of 4.5 percent during the first quarter with balanced performance across both our North America and International business segments,” said Anthony Jabbour, Dun & Bradstreet Chief Executive Officer. “We are executing well, our investments are paying off and we remain confident in our ability to deliver on our full year 2022 goals, advance our long-term strategy, and deliver increased shareholder value.”

Segment Results

North America

For the first quarter of 2022, North America revenue was $367.3 million, an increase of $27.9 million or 8.2% (both after and before the effect of foreign exchange) compared to the first quarter of 2021. Excluding the impact of acquisitions which contributed revenue of $12.8 million, North America organic revenue increased 4.4%.

- Finance and Risk revenue for the first quarter of 2022 was $202.2 million, an increase of $11.7 million or 6.2% (both after and before the effect of foreign exchange) compared to the first quarter of 2021.

- Sales and Marketing revenue for the first quarter of 2022 was $165.1 million, an increase of $16.2 million or 10.9% (both after and before the effect of foreign exchange) compared to the first quarter of 2021.

North America adjusted EBITDA for the first quarter of 2022 was $153.3 million, an increase of 1.5%, with adjusted EBITDA margin of 41.7%.

International

International revenue for the first quarter of 2022 was $168.7 million, a decrease of $1.2 million or 0.7%, and an increase of 4.2% on a constant currency basis, compared to the first quarter of 2021. Excluding the negative impact of foreign exchange of $8.3 million and the impact of divestitures, organic revenue on a constant currency basis increased 4.6%.

- Finance and Risk revenue for the first quarter of 2022 was $109.0 million, an increase of $1.6 million or 1.5% and 5.7% on a constant currency basis compared to the first quarter of 2021.

- Sales and Marketing revenue for the first quarter of 2022 was $59.7 million, a decrease of $2.8 million or 4.5% and an increase of 1.6% on a constant currency basis compared to the first quarter of 2021.

International adjusted EBITDA for the first quarter of 2022 was $55.1 million, an increase of 7.0%, with adjusted EBITDA margin of 32.6%.

Balance Sheet

As of March 31, 2022, we had cash and cash equivalents of $215.8 million and total principal amount of debt of $3,795.9 million. We had ![]() $750 million available on our $850 million revolving credit facility as of March 31, 2022.

$750 million available on our $850 million revolving credit facility as of March 31, 2022.

Source: D&B Earnings Release