E-commerce and retail fraud are increasing at an alarming rate and the financial consequences can have a significant impact on a company’s bottom line. Online merchants lost an average of 8% of their revenue to fraud in 2017, according to Javelin Strategy & Research. With such heavy financial losses at stake, fraud prevention has become a critical issue for e-commerce companies. But businesses are struggling to strike a balance between shutting down increasingly sophisticated fraudsters and not insulting good customers.

How to find the best protection

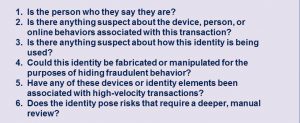

E-commerce fraud solutions can help retailers combat cybercrime while satisfying customers with a smooth online experience. Yet, with so many choices on the market, how do you choose a solution that offers the protection you need? The best fraud and identity management solutions will quickly and accurately help you answer these six questions:

Why these questions matter when it comes to preventing e-commerce fraud…

When a fraudster steals someone’s identity, they have the opportunity to impersonate real customers. And with the increase of data breaches leaking personal information that can be sold to these criminals, it’s important to have a solution that can quickly verify the identity of those attempting to do business with you. Keep in mind, however, that standard identity checks aren’t enough to protect you from fraudsters. Because identities are so easily stolen or impersonated, it’s equally important to find a solution that can quickly evaluate the person’s digital footprint.

A digital footprint — comprised of data like a person’s location, surfing behavior, transaction frequency and amount, and device history — is much harder to impersonate. Any solution you choose should be able to examine the person’s digital footprint in real time. By confirming the customer’s identity and verifying their digital footprint, you’re able to quickly push good customers through and stop fraudsters in their tracks.

A digital footprint — comprised of data like a person’s location, surfing behavior, transaction frequency and amount, and device history — is much harder to impersonate. Any solution you choose should be able to examine the person’s digital footprint in real time. By confirming the customer’s identity and verifying their digital footprint, you’re able to quickly push good customers through and stop fraudsters in their tracks.

Source: TransUnion Insights and Events