Financial news about Detroit is not generally positive these days. However, despite the city’s record-breaking bankruptcy filing last summer, its residents are doing all right with their personal debt. As of February this year, they had the lowest average debt of the largest metropolitan statistical areas (MSAs) in the country, with an average personal debt load of $23,604. That’s a 7.1% decrease from its residents’ average debt in 2010.

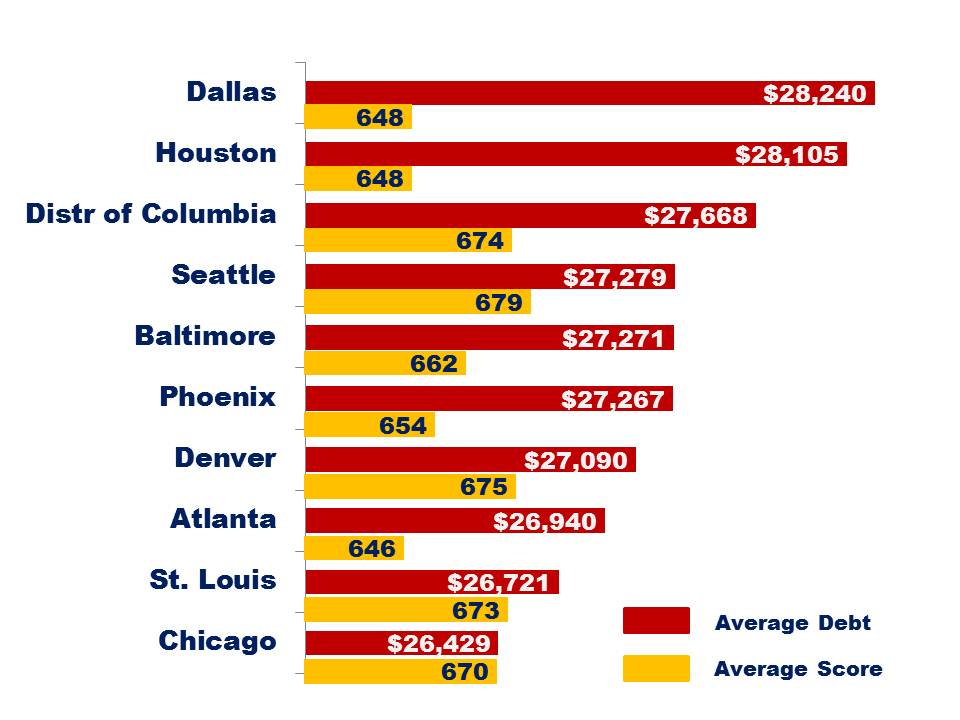

Texans are on the other end of the spectrum for these large cities, according to an analysis by Experian. Dallas had the highest average debt per resident at $28,240, followed by Houston with $28,105. These figures come from statistically representative samples of the MSAs, and the debt includes credit cards, auto loans, personal loans and student loans.

The debt figures may not tell the whole story, but city dwellers definitely have a lot of it. An average U.S. consumer has $25,927 in personal debt, and only eight MSAs examined had lower averages. The average U.S. credit score is 665, and only eight MSAs examined had worse scores.

Big Cities With Big Debt

Half of those sub-par credit scores come from debt-ridden cities. Here are the 10 most-populated MSAs with the highest average debt levels per resident.

Source: Blog.credit.com