Verisk (Nasdaq:VRSK), a leading global data analytics provider, has announced results for the second quarter ended June 30, 2021.

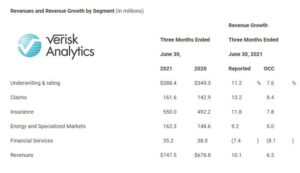

- Consolidated revenues were $747.5 million, up 10.1%, and up 6.3% on an organic constant currency (OCC) basis for the second quarter of 2021.

- Net income attributable to Verisk was $154.0 million, down 14.0% for the second quarter of 2021. Adjusted EBITDA, a non-GAAP measure, was $370.8 million, up 6.5%, and up 4.2% on an OCC basis.

- Diluted GAAP earnings per share (diluted EPS) attributable to Verisk were $0.94 for the second quarter of 2021, down 13.0%. Diluted adjusted earnings per share (diluted adjusted EPS), a non-GAAP measure, were $1.17, down 9.3%. Adjusting for a $0.21 per diluted share impact from a non-cash revaluation charge related to the United Kingdom (“U.K.”) tax law change, diluted adjusted EPS would increase 7.0% to $1.38(1).

- Net cash provided by operating activities was $233.2 million, down 6.5% for the second quarter of 2021. Free cash flow, a non-GAAP measure, was $170.7 million, down 11.5%.

- We paid a cash dividend of 29 cents per share on June 30, 2021. Our Board of Directors approved a cash dividend of 29 cents per share payable on September 30, 2021.

- We repurchased $150.0 million of our shares during the second quarter of 2021.

Scott Stephenson, chairman, president, and CEO, said, “Verisk’s second quarter results highlight the strength of our business model, the essential nature of our solutions and our continued focus on delivering for our customers. We remain committed to our innovation agenda and have strong confidence in our ability to successfully execute our growth strategy and plans to build shareholder value over the long term.”

Scott Stephenson, chairman, president, and CEO, said, “Verisk’s second quarter results highlight the strength of our business model, the essential nature of our solutions and our continued focus on delivering for our customers. We remain committed to our innovation agenda and have strong confidence in our ability to successfully execute our growth strategy and plans to build shareholder value over the long term.”

Lee Shavel, CFO and group president, said, “Verisk delivered organic constant currency revenue growth of 6.3% and organic constant currency adjusted EBITDA growth of 4.2% in the second quarter, demonstrating strength in subscription revenues and recovery in our transactional revenues as we anniversary the onset of the pandemic. We continue to invest our strong free cash flow back into high return on investment projects that support future growth while also returning capital to shareholders through dividends and share repurchases.”

Source: Verisk Earnings Release