It is the third quarter earnings report season and most of the majors have announced their Q3 results. At a glance, there are remarkable differences.

It is the third quarter earnings report season and most of the majors have announced their Q3 results. At a glance, there are remarkable differences.

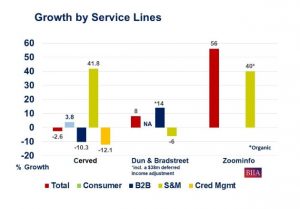

Zoominfo: “… and the winner is a relatively young company called Zoominfo, who reported a 40% organic growth in the 3rd quarter. Overall growth of 56%. It went public in early 2020 and made two acquisitions: Clickagy and EverString

FICO revenue growth for the quarter was 22%. Application revenue grew 12% (45% of revenue); Scores revenues grew 32% (41%) and Decision software grew 36% (14%).

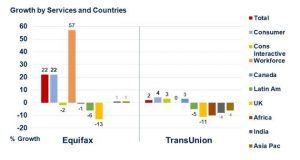

Equifax has recovered remarkably from its Data Breach debacle and notwithstanding the COVID-19 pandemic outperformed its peers. The secret lies in its product mix. At the height of the financial crisis 2008/09 Equifax bought a company named TALX, a leading provider of employment verification and related human resource/payroll services. TALX’s revenue was approximately US$200 million. Equifax renamed the business “Workforce Solutions”, its annual revenue in 2019 was US$949.7 up 15%. Q3 2020 revenues were US$376.8 up 57%. Owning the right business during a recession is often key to survival.

Below is a comparison between Equifax and one of its rivals TransUnion:

CoreLogic broke ranks from its low single digit growth rates and surprised with a 16% growth rate for the quarter.

Fifth in line are the rating agencies: Moody’s and S&P Global. Both reported revenue growth of 9%. Overall, the rating agencies made a killing during the recent two quarters due to the heavy bond issuance of governments and corporations due to COVID-19.

Dun & Bradstreet followed with an 8% growth rate. D&B International reported a 7.2% increase in revenue (constant currency), while its North American business had a decrease of 3%. Its sales and marketing unit in international markets was down 10%. Its North American sales and marketing unit was down 5.8% . The overall growth rate was achieved by releasing US$38.2 million in deferred revenue.

Dun & Bradstreet followed with an 8% growth rate. D&B International reported a 7.2% increase in revenue (constant currency), while its North American business had a decrease of 3%. Its sales and marketing unit in international markets was down 10%. Its North American sales and marketing unit was down 5.8% . The overall growth rate was achieved by releasing US$38.2 million in deferred revenue.

Experian announced a 3% growth for the third quarter without giving any further details.

TransUnion reported revenue growth of 2%. All of its domestic units reported single digit growth, however its international subsidiaries were negatively impacted by COVID-19 (see chart above – comparison with Equifax).

Cerved total revenue growth was down 2.6%. All of its operating units were negatively impacted by COVID-19, while its marketing unit, akin of Zoominfo grew 41%.

Source: Company Earnings Releases (for details go to the BIIA search box to retrieve earnings reports)